-

Honesty

(2)

-

Quality

(1)

-

Cost

(1)

-

Support

(2)

-

Verified Trades

(1)

-

User Experience

(2)

User Review

( votes)Today’s review is Warrior Trading, a day trading room owned and moderated by Ross Cameron. The trading room specializes in momentum trading of low float stocks. The monthly fee for the trading room is $99, educational courses may be purchased with prices ranging from $800 to $2,400. There is a free trial of 5 trading days. In order to access the free trading room trial, you must sign up with Pay Pal. Once the trial period ends, then Pay Pal will automatically begin billing your account.

My Initial Observation

My initial observation of the Warrior Trading website is that everything is neat and well organized. There is a

picture of a group  of sky divers, all falling to earth and holding hands together, a conveyance of camaraderie. The imagery gives a sense of fun and excitement, and teamwork. The images say’s, “We are in this together!”. And “Day Trading Is Fun!”.

of sky divers, all falling to earth and holding hands together, a conveyance of camaraderie. The imagery gives a sense of fun and excitement, and teamwork. The images say’s, “We are in this together!”. And “Day Trading Is Fun!”.

The next that I look for is any button that say’s Performance, or Results. I want to know if the trading room is posting results. You will clearly see a performance button proudly displayed on Page 1. Ok, great so far.

After the performance, I want to see a biography or some sort of write up on the room owner. I want to know whom I am dealing with. On Ross’s About page, you will see a picture of Ross and a narrative of how he got into the business of day trading. As I read the story, I could not help but feel how romantic this story sounded. Ross tells the story of how he was a miserable architect in New York City and he was tired of the rat race and wanted financial freedom. How he dreamed of becoming a day trader and leaving his miserable job behind, and moving out to the country and living in a farm house. I can visually imagine all of this in my head…Ross living in a rustic farmhouse, with dogs and chickens and goats, and of course a big bank of computer monitors on which he rules his simple kingdom of farm animals and day trading.

It all reads so well. And look at Ross, he looks like the guy from the Farmers Market that sells loaves of fresh warm bread. You know the guy I am talking about, he is not materialistic, cares about nature, wants to lead an agrarian sort of lifestyle, believes in Karma, grows tomatoes and cucumbers in his garden, drives a Prius. In a word, NON THREATENING. We all know this sort of fellow, and we trust him because we can generally trust people that have long hair and don’t wear shoes to work.

Furthermore, Ross is an architect. How many architects have you heard that have ever ripped off anyone? Or have done anything wrong? The image of an architect conjures up thoughts of bookish, owlish, honest, earnest, hard working, building something, educated. NOT A HUSTLER.

Furthermore, Ross is an architect. How many architects have you heard that have ever ripped off anyone? Or have done anything wrong? The image of an architect conjures up thoughts of bookish, owlish, honest, earnest, hard working, building something, educated. NOT A HUSTLER.

Ross Cameron projects himself as NON-THREATENING, and NOT A HUSTLER. And yet he is now a trading guru. And we all know that the realm of trading gurus is located in the very heart of Hustlersville. So, the big question is whether our granola eating day trading guru is pushing a scam. In effect, is this a wolf in sheep’s clothing type situation. Let’s present the evidence.

Initial Contact with Warrior Trading

A reader contacted me on February 6, requesting that I write a review of Warrior Trading. On Monday, February 9th Ross was holding an open house. In other words, for that one day only, Ross was allowing anyone to sign up for a one-day free trial, without having to submit a credit card number. I signed up and recorded the event. Generally speaking, I am very suspicious of these one day open houses because the trading guru is going to be on his very best behavior. These events are generally well rehearsed, scripted and presented in such a tone and manner that the moderator cannot help but look great. Think of these one day free trials as a one-day free tour of the local butcher. On this particular day, you walk into the butcher’s shop and you see the perfect displays of sausage, cuts of meats, etc. It’s all looks so clean and nice. But really, the thing we need to see most is the business end of the butchers’ shop. In order to figure things out, we want to see what is happening with the sausage making, and where the meat is locked, and the cleanliness of the place, the back of the place. I have personally found that these one day, free trial trading events are scripted and useless sales presentation. And in the case of Ross, I needed to enter my credit card number, pay for a subscription, do some hardcore screen recording on Camtasia to figure out the truth.

Insider Observations Of Warrior Trading

Before I get into the meaty details, let me first explain something about Ross’s trading style. He specializes in what are called low float stocks with high momentum. What is a low float stock? Simply put, there are not a lot of shares on the open market. For instance, General Electric is a high float stock, there are plenty of shares outstanding, the stock is highly liquid with an average of over 40 million shares trading each day. Why is this important? Because stocks with a high float and a high daily trading volume have very tight spreads. Therefore, if the price of GE is currently 27.05 per share, then at any moment during the trading day, you can easily execute a market order to buy GE at 27.06, or a market order to sell GE at 27.04. The spread to buy or sell is very tight, the market is very deep with plenty buyers and sellers, and there are massive amounts of shares floating around.

Ross likes low float stocks that move fast. Here is the problem, stocks that have a low float and high momentum have a problem with wide spreads. What does this mean? This means that since not many shares are floating around, and these stocks tend to move quickly, then the cost of executing a market order can be very high. Example: XYX company is currently selling for $8 per share. To execute a market order to buy, a person would have to execute at $8.05 to immediately execute the order. A person would not enjoy the added liquidity of a high float stock, a person would have to pay a premium of .05 to immediately execute the order. Conversely, if a person executes an immediate order to execute a short trade, or exit a profitable trade, or exit a losing trade, then this person is going to pay this .05 at every angle. Another term, that futures traders use would be “slippage”.

A rookie with little knowledge would be reading this and be thinking to themselves…”hey it’s only a nickel, what’s the big deal?”. But it’s a big deal. It’s big fucking deal. And it highly skews performance from Trader A when compared to Trader B. In fact, Tim Sykes, the popular trading guru has had a big problem with his trading service because of this very problem. He would initiate a trade in a lightly traded penny stock, then blast out to the subscribers that he just entered an order. The subscribers would then trample over each other to get into the trade, which distorted the price and caused so many problems that Tim had to create a swing trading service because of all of the complaints. In a nutshell, the moderator buys at $8 per share, then tells everyone that they should buy. Everyone jumps in at the same moment and the price jumps to $8.20. The moderator wins, everyone else loses.

Now that you have a basic understanding of how a low float with high momentum greatly affects the entry and exit price, I would like to put this information into the context of Warrior Trading and my individual findings.

Real Time Observations Of Warrior Trading

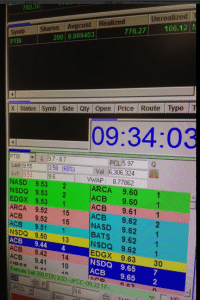

From the week of February 23rd, 2015 through February 27, 2005. I recorded and observed everything that happened inside of the trading room. I was able to confirm that 44 trades were actually called live, by Ross inside of the trading room. At the end of the week, Ross reported a profit of about $9,000 from his trades. Am impressive number! However, at no time during the week was I able to visually confirm the presence of a trading DOM on Ross’s screen. What is a trading DOM? A trading DOM is a price ladder that shows exact prices, allows order entries and exits, and shows the spread at the current price. Also, and most importantly, a trading DOM will show the real time profit and loss for the current position. Ross was not willing to show this information.

During the week, I sent Ross an email requesting that he show the DOM on the screen, this would show us that he was actually executing trades. However, Ross ignored my initial emails and began dodging me. Little did Ross know, that all of my emails are embedded with a tracking program that notifies me in real time, whenever my email is opened and viewed. I could see in real time that Ross was opening my emails and I was expecting him to respond. Ross would not respond. I would email him the next day and he would respond that he did not receive any such email. I knew he was lying. He did not know that I was watching him open the emails.

After Ross refused to show his trading DOM, I then asked him if he would send me a .pdf of only one day’s worth of trading activity. Every broker sends out a nightly report of trading activity, and any account numbers can easily be redacted to hide an account number. I was not asking for names, addresses, account numbers, or any personal or private information…I only wanted to see that he was executing trades, for only a single day. Again, he dodged me with all sorts of excuses about not receiving my messages. It was all nonsense. I canceled the membership shortly thereafter.

Review Part II-More Of The Same

Typically, I like a minimum of two weeks of screen recordings before I write a review. More evidence is better than less evidence. In the case of Ross and Warrior Day Trading, I then signed up for yet another subscription on May 4th, 2015. The newest subscription was under an assumed pen name, an IP address different from the original client  address, and a Pay Pal account that was established with a pre-paid debit card. Why do I go through all of this trouble of hiding my identity? Because I want to create the illusion of different personas, I have found that the trading Guru will treat Aunt Margie differently than Cousin Carl. They craft the message to the audience.

address, and a Pay Pal account that was established with a pre-paid debit card. Why do I go through all of this trouble of hiding my identity? Because I want to create the illusion of different personas, I have found that the trading Guru will treat Aunt Margie differently than Cousin Carl. They craft the message to the audience.

During the second round of screen recordings and review, nothing has really changed since February. Ross still refuses to show a trading DOM to viewers, so we have no idea whether he is actually making any trades, and if you send him an email showing an account statement, he again acts like he did not receive it. However, this most recent request for an account statement, I got a bit more aggressive and demanded proof of actual trading. Ross responded by sending me a picture that he took with his smartphone. This appears to show something. But not really useful. Why? Simply put, most of todays modern trading software allow a replay mode on a simulated account. What the fuck does that mean? It means that a person can watch the market in the morning, and then go back with a simulator and enter and exit orders at exactly the optimal moment. The trading platform records the trade as “real time”. The trading guru then uses this information as marketing fodder. A slight of hand gimmick, and one used very often on Profit.ly. You can read more about profit.ly here and here.

When I ask for proof from a trading vendor, and he sends me a picture that he took with a camera phone…this screams fraud and fake. Why not just be honest and send me a redacted account statement, many vendors do this for me now. Heck, the guy that runs Night Scalper gives me so much proof that he is borderline obsessive in proving how real he his.

How This Looks On Video

The following video is an example of a trade the Ross took in the trading room. I have videos of both winning and losing trades, but this video, in particular, was a big winner for Ross. The stock really broke out to new highs, however, the Ross never gave the room much of a warning that he was getting into the stock. He just announced, “OK, I am Long!”. Then after the stock breaks out to newer highs, he announced: “OK, I am half out!”. How many shares? At what price did he get? Again, the room members have no advance information and we have no idea what is going on.

Losing Trades

The example above was for a perfect winning trade. But what about the losing trades? The losing trades drove me bonkers. Why? Because when the price moved against Ross, he would shout out, “OK I am OUT!”. Really? Just like that? We are sitting there holding our trades and you never gave us a stop to exit! The market continues to move against us, and now we must exit at the market, with no warning. And remember, these are light float stocks with high spreads…so we get slaughtered on a market order. Amazing stuff folks.

A Message For Ross

Warrior Day Trading is a fraud. I do not believe you, Ross. The trades that you call in the live trading room cannot be replicated. Even on a simulator, with recorded time and sales, my virtual assistant was not able to come anywhere near what you post as actual results on your website. However, I sincerely want to be wrong. But the evidence is so deep, damning and thorough that I simply have to declare that your trading room is one of the most deceptive trading rooms that I have ever witnessed. The fraud is subtle. The deception is slight but powerful. You are very good at creating small angles where a person of lesser intelligence could very easily be swayed into believing that you are real. Please, Ross, prove me wrong. Release an account statement, this is the only way that I will ever be convinced that the fantastic results posted on your website are the true and honest results that you yourself are present as fact.

Thanks For Reading

Thanks for taking the time to read this post. It’s long and I was especially tough on Ross. But I feel that Warrior Trading is highly deceptive, is a complicated fraud, and I wanted to make sure that I captured enough video evidence before I wrote such a scathing review. Many of you will disagree with me, and I hope that you will reach out to me and express your opinion. In fact, I hope that you can convince me otherwise. Nothing would make me happier than to eat humble pie.

I think WT may also be involved in a pump and dump scheme, besides scamming people into taking his courses. If you research the stocks listed in his YT presentations, a lot just have a huge spike and subsequent collapse.

LoLOL! Good going guys, and the FTC on getting this case going against this one of the biggest slipperly snakeoiler Ross of his outrageous shamshow, Warrior Trading!

“injunctions” for:

“PROHIBITION CONCERNING EARNINGS CLAIMS” , “permanently restrained and enjoined from making any Earnings Claims or assisting

others in making any Earnings Claims, expressly or by implication, unless the Earnings Claim is non-misleading, and”

,

“II. PROHIBITION AGAINST MISREPRESENTATIONS”, “A. Misrepresenting or assisting others in misrepresenting, expressly or by

implication, that:

1. A consumer can attain proficiency in using Defendants’ trading

strategy, regardless of education, background, skills or other inherent

aptitudes;

2. .. 3.. 4..(blah)”

“III. PROHIBITIONS REGARDING TELEMARKETING” .. “D. making a false or misleading statement to induce any person to pay for goods

or services; and”.

Yup, yup, and it’s been freaking over FIVE years since tradingschools exposed this sham. And so many got suckered still during that time because Ross was so good and slippering around another “benefit of the doubt”, “what if” nonsense for potential new dupes. Even reddit’s /r/daytrading had been influenced by ross so that the mod bot even alerts or takes action if you even mention ‘warrior trading’ in full typed name, sheez. Ross even got lightspeed broker to feature him in “beginner instructional webinars” on their site. And as Emmet had also revealed of his paid off fakery on that joke, “Trustpilot” site. This clown had gotten away it for so long as far back when he claimed to be an architect , when actualy he was a shamshow room mod for Jason Bond! back before circa 2015, sans glasses and mustache , lol, saved for anyone to see on archive.org ; Man this shamshow of WT has been one of the worst, not as big in your face marketing as Bond’s Raging Bull, but effectively still as cesspool stinky as an open sewer hole on the block and very damaging to newbs, as plenty of them, as evidenced on reddit, are still trying to do the “gap and go” and “momentum” catch crap low floats near opening bell, just like Ross when he really ever did was pump and dump however many of current room subscriber dupes were in the room for the day.

So thank goodness, the FTC acted and congrats to all those unknown and unnamed victims who successfull combined their complaint submission efforts so that the FTC finally took notice.

I’m looking very much forward to more details if revealed by the FTC investigation on how Ross continued his shamshow of faking profits and consistency. Recall in our old comments here on this review page years ago , Ross himself was responding to our posts and cleverly reacting to speculation and accusations here. First, way back, he only did a stupid spreadsheet table printout on his “results” site of like making $100k+ back in 2013,14. Then after our comments, he started “resetting” his account to 25-30k only or something like that and reporting month by month profits, pretending he was taking out funds to reset it back to 25k. Whatever finagling shellgaming he was doing for the fakery record. The printouts looked a little more “authentic” with some broker detail crap splatterd on those pages. Then lol, after reacting to more comments he started faking up a broker lookup page, when it was probably just some web programmer putting up fake html or whatnot to make it look like a statement. And even after that, a video to make it look he was clicking on a broker and looking up a statement, when it could have been a local server mock up to look like a broker page!, lol. man, the depths these shams will go, and particulary Ross is one of the cleverest slippery ones as Emmet mentioned on the summary of this review way back. Even some corrupt brokers could be in cahoots with him. When I was duped for a short while, I even saw Ross accidently uncover another of his sim accounts , he probably used to mix match for fakery in the web “results” section, or some fakery in a future video. It looked like some DAS clone trading software. And later on he used some thinkorswim, or whatever he used all over the place to fake his scam.

So, yes, looking forward to more details from the FTC , if they reveal anymore of their own investigations. Where their injunction clearly mentioned Ross’ results were misrepresented, so they came to conclusion a bunch of it was faked. And those details on how it was faked they found out would be fun to know! And really hope there is more action done past this injunction. This site and shamshow was one of the worst and visible stinkers of the last past half-decade, probably equal or surpassed the former guru-“popularity” of Sykes.

The FTC finally takes on the Scameron?

https://www.ftc.gov/news-events/news/press-releases/2022/04/federal-trade-commission-cracks-down-warrior-trading-misleading-consumers-false-investment-promises

Did you find this review helpful? Yes (6) No

STIPULATED ORDER FOR PERMANENT INJUNCTION, MONETARY JUDGMENT, AND OTHER RELIEF

Good call…

https://www.ftc.gov/system/files/ftc_gov/pdf/2023198WarriorTradingStipulatedPermInjunction_0.pdf

Did you find this review helpful? Yes (6) No

Correct. I will draft an article on how it all went down.

This is why these negative reviews are deceiving...

These reviews are so ridiculous. ANY SMART TRADER WOULD KNOW NOT TO ATTEMPT TO COPY HIS TRADES!!! No wonder 90% of day traders fail. His training programs are designed so you can learn what trends and patterns to identify. You are supposed to have a business plan, written trading strategy before you even jump into a trade. To jump in without knowing your stop loss is plain stupid. There is also a lag time from the second he places his trade. By the time you try an copy him, he is off course probably selling. He is providing examples of how to day trade. It is up to a real trader to do the homework, study different books, learn patterns, trends, technical analysis, risk and money management before even jumping into trading with real money. If you watch his FREE YouTube channel- HE EXPLAINS ALL THIS! I guess the idiots losing money are just plain idiots that have no place in the markets. Find another side hustle if you not willing to put in the time to learn the craft.

Did you find this review helpful? Yes (11) No (23)

Has anyone else noticed WT “broker statement” profits for 2020 on the site’s results page? It’s so ridiculous now. $4.5 million profit for 2020, with some months reporting $500k in one month. Yet the average length of the trades are just 5 minutes! –> (https://www.warriortrading.com/verified-earnings-2020/)

Why hasn’t the rumored investigation since this summer reported proceedings yet? Has slippery Ross slipped the noose again Emmett? Just freaking incredible, insanely ridiculous, and I wonder if the chatroom must have tens of thousands of dupes by now. (last time I was in there was 2016; fortunately I saw through the facade quick, and did my own method trading so as to not get pumped and dumped by this fraud so I didn’t lose money, but this review back then also confirmed how disgusting this shamshow is).

I hope the FTC and regulators put a stop to this and all the hundreds of thousands the victims must be losing every month to this pump and dump room. Basically take away the chat room, free WT, and let that fraud show how he can’t really trade without a duping chat room and a bunch of dumped followers. And yes, as Emmett proved long ago, Ross Scameron was a mod in the Jason Bond picks room during the time he lied about being an architect on his site back in 2016, where he even paid off archive.org to remove all traces of Warrior then, but laughably, he couldn’t remove Jason Bond’s list of scam room mods of which he was back in 2014-5.

“http://www.jasonbondpicks.com/meet-the-traders/” –> (https://i.imgur.com/B7fH3Bb.jpg)

I was looking for info om Warrior Trading, and while im not a trader i can clearly see that this is BS and this guy was after Ross and looking for excuses to bash in. I dont know if ross courses are good or not but reading all this hate just make me want to know learn more about him or his course, also if you are stupid enough to blindly follow all his trades and expect to make money that way without doing the work than you deserve to lose everything. Do better and stop embarrassing yourself with this kind of weak bs.

Did you find this review helpful? Yes (19) No (28)

I see you guy's pain...But

Come on y’ll.. Most of the complaints is that he’s taking the opposite side of your trade. The stock market is huge and a bit more studying before dropping $4k you will help you see that his followers cannot move the market enough for him to profit this way. Let’s say that he has even 10,000 active traders in the room. You think they’re all taking the exact same trades, at the same time, at huge amounts of sizes as he is? At best a few hundred here and there is being traded, at 10,000 different times IF 100% of them are trading that morning, at those same stock picks, etc.

I would guess 30% actually pull the trigger. This would be pennies relative to the institutions and hedge funds taking part in the huge movements that happen at market open. This ain’t the same as the meme stocks back in January where you have the world honing in the same stocks.

Did you find this review helpful? Yes (9) No (8)

There is a reason why Ross only trades “low float” stocks. You only need one newbie to enter or exit their trades using a market order in order to move prices higher or lower. Now multiply this by 500 people in the chat room.

These 500 people are literally paying him money to watch him make a trade. Of course, Ross says “don’t follow my trades” with a coy wink. But these poor sheeple are going to do just that — follow his trades — to emulate his success.

Remember, the whole “trick” is to find a greater fool and convince them to buy your securities for a higher price than you paid. Ross is always the first to enter and the first to exit. Is this illegal? Nope.

Enough of his paying customers have contacted me over the years. And the story is always the same. These paying customers usually say, “I wanted to turn $500 into $1,000,000 in a year, and I thought I could do this by simply copying what Ross does.” But when they attempt to copy his trades, they are entering and exiting after him. He is the first pig at the trough. He eats first. Again, nothing illegal here. Its just stupid, naive, greedy people doing what Ross tells them not to do… “Don’t copy my trades.”

Anyone can do what Ross does. But you need a huge advertising spend to consistently lure in fresh batches of newbies with $500 accounts.

Nothing negative or positive to say since I haven’t gone through his course

6 years later and he’s still doing his thing, so…

Did you find this review helpful? Yes (1) No (16)

I’d like to add this, for anyone who feels like the ‘contract’ they agreed to, essentially prevents them from talking about bad experiences with Warrior Trading. Nobody can legally ‘gag’ anyone in this way. Here’s all you need to know:

The 2016 Consumer Review Fairness Act prohibits businesses from using form contract provisions that bar consumers from writing or posting negative reviews online, or threatening them with legal action if they do.

Simply put, the CRFA prohibits businesses from requiring consumers to agree to contracts that have specific conditions against publishing negative information.

Ross is a clever, sneaky, slippery mother fucker. And he is lucky as hell. I mean really lucky. His neck has slipped through the noose on several occasions. I thought for sure the regulators would have crushed him by now. And believe me, I have done just about everything in my little circle of influence to get the regs involved. But he just keeps on slipping through the cracks.

Oh well, you cannot win them all.

Lol how about you freaking losers except some responsibility for being broke and unable to generate a profit doing, well anything. Crying because you thought trading was a get rich quick business but you found out a lot of work is involved. You were born to be a ditch digger and Mr. Cameron did not choose that fate for you. Stop blaming others for your parents bad genes. Pick up a shovel and do what you were made for. And be happy in your work

Yeah this review is complete BS. There needs to be a 3rd party reviewer for 3rd party reviewers haha

Lol! I agree!

Hi all I have been watching Ross for a while and he actually inspired me to start trading, after I figured out how to trade I actually opened an account and watched Ross live, he does what everyone is saying, he will pump and dump a stock with no news and say things like if it goes past 6.50 I’m all in everyone puts in a limit order for 6.50 which is actually Ross sell limit, 6.50 hits he takes the cash and runs everyone else is then stuck as the volume disappears because it was all Ross.

I believe he is actually trading and making the money he says but only because of the reason above but also he is trading with huge size watching him live he lets slip he is buying $110,000 trade on $5 share so he only needs it to move so slightly to make thousands and with all of these followers following his every move to push up the price it’s a great system for him.

That’s 22.000 shares if the price goes to $6 he makes 22k and this penny like stocks can move $5 in a morning session if you watch his trades he will sell instantly and actually sell at 0.5 % increase that’s all he needs.

My advice is watch his live stream and steer clear on anything he is trading.

He does show his red and green days which contradict his method as he shows only a few trades live in a few hours and says that’s all he does yet his trading reports say he trades 40 plus times a day.

Ross is just a good scalper and is doing it with huge size on a margin account. No wizardry or magic he’s also making money as a guru from students lots of it ! So he doesn’t care if he loses which is taking the emotional element of trading out of it somewhat as all of these sheep are cueing up to pay over thousands for his secrets.

So is he a scammer ? Not really people are too stupid to blindly follow people for a get rich quick scheme, he is however a master manipulator of the market and his students.

Yes, we’ve got it. You are a believer, as you said

Years ago Emmett will remember I was involved in Ross`s room for little over 12 months, I was a day trader specializing in trading new IPOs launched on the day. I had been tutored by one of the USA best IPO annalists who sadly passed way in 2013. I was also day trading and using WT chatroom for somewhere to park whilst using Trade Ideas scanners and trading before the market opened.

I noticed this was a common thing Ross was doing then he would talk up the shares and sell most of his holding well before he publicly sold the balance.

There were five in my group watching what was going on and we were secretly in sync with what was going on, believe me, Ross learnt from Jason Bond one of the best scammers well before WT.

We collectively made over $500k without Ross knowing we were in the background.

I made some comments in this feed and got slapped with $5m law suit from Ross mainly because one of his team had been up for being a pedophile and was exposed as being a dodgy trader in the group

long story short

over my time in that room I saw over 500 people complain about how much they had lost including the fees they were charged not one person ever came out on the right side following his trades unless you bought when he did pre opening and sold before he did.

Better to go to trade ideas chat room for expert advise which is free and more trustworthy in my opinion.

Yes, we know about Jeff Fortis’ convictions. It was exposed in court filings but hasn’t been made public yet.

Why don’t you contact the FTC about Ross and Warrior Trading?

I’m sure that they would LOVE to hear from you.

crobbins@ftc.gov,

skim6@ftc.gov,

gsommers@ftc.gov,

tbiesty@ftc.gov

Lol how about you freaking losers except some responsibility for being broke and unable to generate a profit doing, well anything. Crying because you thought trading was a get rich quick business but you found out a lot of work is involved. You were born to be a ditch digger and Mr. Cameron did not choose that fate for you. Stop blaming others for your parents bad genes. Pick up a shovel and do what you were made for. And be happy in your work

Hey Aaron, I totally agree with you! You have to work hard to earn your success at trading. My gripe with Cameron has to do with day trading and how he always seems to get into and out of his trades while the subs copying his trades gets their accounts drained.

Anyone can become a millionaire day trading low float stocks, but you need several thousand people in your chat room attempting to replicate your trades, which helps you into and out of trades.

Yes, we know about Jeff Fortis’ convictions. It was exposed in court filings but hasn’t been made public yet.

Why don’t you contact the FTC about Ross and Warrior Trading?

I’m sure that they would LOVE to hear from you.

You can email the same attorneys that are working the Raging Bull case since I’m sure they may already be investigating WT.

Hey “Applied Trader”

Yes, I remember that lawsuit very well. They were supposed to drop the suit entirely, once I was removed. But they did not, and instead chose to make an example of everyone (but me) as a warning to anyone else willing to speak out about their little scam. The $5 million default, they never intended to actually collect, but instead to be used to terrify their own students from ever speaking out.

These are classic “SLAPP” or Strategic Lawsuits Against Public Participation.

If you are concerned about that old default judgment and would like to have the judge vacate the order, this should be easy enough. Please contact me directly emmett@tradingschools.org and I will have my lawyer handle this…pro bono. You were brave enough to speak out. I will not abandon you, or anyone else willing to speak out the truth. Contact me.

Nice information, Its always good to do proper research before jumping into any of these investments. I would not say all are scams but its soo easy to fall prey. I lost investing in btc at first, was able to get some of funds back after consulting calgarysec-hack, you can google them. Now i’m thinking of investing in dodgecoin

I am just going to repeat what I wrote in replies below. His ‘verified performance’ does not say much.

What exactly does the verification say? That the note 2 is prepared in accordance with the rules in note 3 and 4.

One can :

And that is all I see in this ‘verified performance’. There is no broker statements, just Ross’ own statements of how to calculate percentages of some numbers and some account numbers written by Ross. Citron does not state that the ‘verified performance’ is in fact in accordance with the statements from any from these brokers. So verification covers only things written by Ross, not by brokers. And where I see brokers statements , there is no verification that they are correct or refer to real money.

Thanks for the comment.

The big problem I have with Ross is that he has the benefit of hundreds of people attempting to replicate his trades — as he is making his trades. Front running the subscribers. It is perfectly legal. But it’s just not right.

Making money is easy when you have 700 people buying after you buy, and selling after you sell.

Hi Emmett. That’s your “theory”. But in all reality you have no proof of that happening or if it’s even realistic. Read my comment right below why. Reading your biography, I don’t even think you actually trade or even tried it. Also your obsession with showing the DOM. Most day traders don’t trade from DOMs. They trade from charts or use hot keys.

I don’t believe you have the judgement to tell if what you believe might be happening actually happens. If you have proof, or any concrete evidence that people from Ross group drive the price up, please share it with us. As i wrote, there are thousands of shares at each price level in those stocks that day, you can check tht for yourself, and after he takes trades i do never observe any abnormal price or volume activity. In fact price might as well go straight against him. And why is his win rate only 70%? Shouldn’t it be 100%? How many cents do you think his slippage is? How many shares do you think those 700 people buy right after him? And why is it not visible in the volume recorded by the exchanges?

Oh, and if you could please share any of your broker statements with us that show that you are a successful trader, that would be nice!

After reading a bunch of reviews + the comments, i have to say, I rather believe the comments. Even when they say the total opposite of what you are saying. You have a history of defrauding people, even being in prison for several years, as seen by your biography. Why should we trust you here? Change of heart? I am sure you make a good amount of money with that site.

It’s sad that your site can’t be trusted, The reviews and the star ratings are essentially worthless. It would be important to have a good site like yours. But this isn’t it and it will never be.

As a successful student of Warrior Trading please share your brokerage statements Peter, even better get Ross to share his.

Hi Peter,

Thank you for the thoughtful comment. You bring up many good points.

If I may respectfully reply, I believe that readers should take each review on their own individual merits. Essentially, as a critical reviewer, it is my job to find every blemish and also bring attention to any potential blemishes. Do I ever get it wrong? Sure! I get it wrong all the time. And when I get it wrong, I then reevaluate and then write about those issues. To date, I have written hundreds and hundreds of reviews, so you have to give me just a little margin of error. I am not perfect.

You asked for my brokerage account statements so that I can show you that ‘I’ am a successful trader. But this has nothing to do with my reviews. For instance, here in San Diego, we have a notorious restaurant review critic that absolutely lambasts local restaurants. Even the 5-star restaurants get slammed for anything from a rude waiter or a soup that is too salty. This critic does not own a restaurant, nor has he ever worked in a restaurant, yet his reviews are the stuff of legend. Readers enjoy his material because they know that the review is funny, and he always finds the worst items on the menu. It is a valuable service that he provides, and it’s a fun read.

Now, you make much ado about my past criminal conduct. As you should. But consider this…I could have just as easily created this website using a fictitious name and projected myself as a model of purity and innocents. Ponder why I do not hide behind an anonymous identity?

I will tell you why. In today’s modern internet era, where the truth is negotiable, and nearly everyone projects phony images and stories about themselves…isn’t it refreshing when an ugly warthog — like myself — shows up and just lays it out ugly and real?

Even if you do not agree with my review of Ross Cameron and Warrior Trading, surely you can find something on my blog where you do agree.

Thanks again for commenting. I sincerely hope to read more of your comments in the future.

-Emmett

Guess what you are fucking retarded

These so called “low float” stocks that Ross trades are traded in the millions of shares that day, even in the pre market, because they gapped up like crazy, often turning over several fold their available shares in a few hours.

When you would ACTUALLY look at the DOM at that time of those stocks, you would realize that the spread is often 1 cent (or maximum a few) and hundreds to many thousands of shares are available at the best bid and offer at any time. How do I know that? Because I checked, and so can you. Just take a scanner that finds the stocks that fit Ross criteria and put the DOM on.

Share prices traded by Ross are usually not lower than 5 dollars.

I do not think you ever had a DOM open while you were trading alongside with Ross, otherwise you wouldn’t actually write what you wrote.

If you want to show that you are a person of integrity please update your post after checking for YOURSELF.

If he’s a fraud he’s extremely good. I noted after months in the chatroom that on trades that start to turn against, he’d talk it up so the chatroom buys while scaling out. But he also tells people not to follow him blindly. Having said that, 4000 people in a chatroom jumping on the same at the right setups can move a stock significantly if the company worth is only 50mil. You don’t see his p&l live and you don’t see his fingers. Having said, I really appreciate Ross and he’s a superb teacher and Fraud or not, he encourages everyone to trade in the simulator until green so there is really no risk on the students side. It is hard and Ross’s style is very advanced because it requires and intuition that develops only with experience. If you wanna learn to day trade/ get into it, you’ll definitely learn the ropes here. Expect to be read for a few months though, which is absolutely normal in any serious profession at first.

Another site doing the same thing as Ross. “Truetrader.net”. The name reminds me of “‘trust’pilot”, when WT is invovled, it turns sites into a mocker of “truth and trust”. What a shitshow. This poor guy reported his dwindling account. (https://www.reddit.com/r/Daytrading/comments/h0r0di/truetradernet_avoid_at_all_cost_lost_my_money/) So this shamshow is another WT wannabe offshoot, pump’n’dump , fake actored room, fudged shamshow results (https://truetrader.net/results/), shamshow cess.

Ross focuses on low float stocks (pump and dumpable) on a breakout (also perfect for a pump and dump maneuver). TrueTrader focuses on high cap stocks approaching institutionally held buy/sell levels via a reversal strategy. I am in their service and can say that their results are from their daily live stream. They post the full morning stream recap for members to go back and look. I’ve audited it several times and the reality matches the results stocks, entries, and exits. Not sure where you’re getting your claims from but it sounds like armchair opinions. So bonus points for being edgy.

Post your brokerage account statements and get Ross to post his too.

Wow, just armchair? I posted the reddit post link of a complaint otherwise about truetrader. And there is also another here at tradingchools the other day -> (www.tradingschools.org/add-listing/#comment-5061424 ) . And I know first-hand about Ross and his scammy ways since back in 2016 when I was in his room for a few months when someone mentioned this WT review and so I discovered tradingschools and finally someone who can’t be bowed down by the shamshows’ legal threats paid for by the duped money. As the feds are watching him and these reviews and comments. Ross’ room was different then, he had less members, and was posting more of an simple sham of “tables” of yearly profits per trade, and everyone who wised up knew then also that the trades didn’t match up to what was in the room. And he only posted an occasional “winner” like it was a celebration while glossing over so many supposed scratches or losers like it was always a “tough” day. And oh yes, the fake “I was an architect” lie and the stupid group skydiving pics. Funny thing is that Ross cleverly followed this comment page back then and adjusted to more perfect and fund his scam. Putting up more dummy fake broker screenshots, then trying to mix real with sim. I even caught it when he accidentally showed some of his sim extended window showing clearly a sim mockup account. I think he mixes sim and some dummy real. All traces of the old website can’t be found now since he’s bribed or paid off archive.org and ripoffreport and trustpilot among other. Now that he has far more members, he pumps’n’dumps an occasional trade to mock up his fake “live record” while leaving many in the chat holding the bag. All this is referred to in past posts right here in these very comment pages leading back to 2015. And Emmett had to win two lawsuits from Ross to keep this page and comments up. Their “warrior pro” was always seasonally or special day “discounted” to like $2k. Now it’s always discounted to about $3k. So either you are a shill, a very fresh duped newb, or a staff of WT or truetrader.

There have been 2 recent posts defending Ross Scammeron so it’s unlikely that they are from “a very fresh duped newb” My money is on Scammeron has got some new meat in the office cutting his teeth on trying to create doubt that Warrior Trading is a scam from start to finish.

ds

I beg to differ. Ross is the genuine article. However very few of his students will ever become successful lowfloat scalpers. That’s the harsh truth. But many will go on to learn other techniques. Ross is like a highwire performer. Entertaining and reliable. But not somebody we can imitate. There are way smarter investors with better techniques than his, it turns out.

Great comment. And you are correct about the “harsh truth” of day trading. I drafted an article on the abysmal failure rate of day traders here:

https://www.tradingschools.org/reviews/day-trading-its-for-suckers-heres-the-proof/

Ross is definitely entertaining. Can we imitate him? Well, considering that I have spoken with too many former Warrior Trading students…trying to replicate exactly what he is doing is a recipe for disaster. Granted, he does warn people to not shadow trade, but still, these folks show up to do exactly that. That’s where the problems are quickly revealed. I try and handle Ross with gentle gloves because his ads are always appearing on my website. So there’s that.

Regardless, people try and shadow trade. And so the next question…can we circumvent the learning process by shadow trading, successful traders? Recent studies of various shadow trading platforms reveal a very troubling trend. In fact, I am drafting an article where a group of German scientists studied this very question. Its a relatively new study and gained no traction in US media. Primarily because it rubs wrongly against commercial interests.

But writing articles with little commercial value is what I seem to always do! Stay tuned.

Anyway, one has to wonder if Ross can trade without the help of his massive army of trading room subs. This creates a massive wind at his back.

Emmett, I wish I’d found your website 18 months ago. I’ve spent probably $2500-$3000 on inferior trading classes and services. It takes quite a bit of knowledge to know the diff between the good and bad services. Unfortunately the best services are probably the ones with the lest amount of marketing. Thanks for providing this much needed review service. BTW I believe day trading can work, or at least have a place in your arsenal, but it’s very much like learning to play an instrument: requires years or practice and dedication and the right instructors. Check out a Wealth365 Summit sometime. Some genuine pros there.

Yeah, sure. You overlooked the basic contradiction in his thingy: why selling courses, chat room time or whatever shit if he is applying his amazing knowledge and techniques? It must be a carefully designed technique if he is pushing everyone in a subtle way to buy his hit. However, to try to avoid big problems with FCT/SEC he is posting everywhere (even in his videos) all sorts of disclaimers like “I just give opinions, not advice, nor technical shit” etc , and also those weird documentos kinda P&L. They just show at best how much money he gained front running his “students” and/or money from suscriptions. You are under the “illusion” part of the scam. The guy is dangerous, as a pro con artist he is, he combine true with fake. Sure, courses with some almost coherent contents….but whats behind curtains? Kee being a believer. Tell us when you recover your brain

The problem is people are going into Warrior Trading and other courses looking for some magic method to get rich, there are no shortcuts. If you study and practice with paper trading you will improve. The methods and strategies that Ross teaches are used by tons of day traders, the problem is students that fail tend to blindly follow what’s going on in the rooms rather than actually trying to learn themselves. Don’t take trades because other people take them, learn how to find the stock yourself, where to enter, and when to exit by practicing everyday. Never start live until you are consistently green.

I have done courses from Tim Sykes, Steven Dux, and Warrior trading. They all essentially teach the same thing and all say don’t follow what I do. So if you fail, it’s your own fault, you don’t blame the hardware store for selling you a tool you don’t know how to use.

Point being, you can take all the courses you like but if you don’t work hard at it your not going to succeed. They are not there to make you successful that’s on you, they are there to give you the tools to become successful, if it were easy then everyone would do it.

Great comment.

But I would like to add an extra point. Day traders should avoid simulators altogether. A simulator will tend to easily fill limit orders, and exit trades with no slippage. This creates a false sense of security, and sets the trader up for wild failure.

With trading essentially now free, budding day traders with small accounts should instead attempt to trade 1 share per trade, which is essentially trading on a simulator, but this will give an accurate portrait of what is actually possible.

I know that I have sat there for 30 minutes watching the price touch, but never fill. Whereas a sim trader will always, or nearly always get filled.

@john , Sykes and Dux are shorters so wouldn’t they be different to warrior? Plus these guys do live call outs so as long as your initial sizes aren’t too big, can’t you just play the percentages and be profitable immediately? Maybe not go for 100% runners but take profit at 25%?

Thanks for taking the time to review. I’ve been watching Ross on Youtube and began searching for articles about his program. Experimenting with Ross’s strategy (from what I’ve gathered in his YT videos), I’ve been able to make relatively large, consistent gains. Returns have been much, much better than the technique I had previously been using. One cannot follow his ‘call outs’ and simply copycat his moves. Low-floats move too fast for that.. he very openly and repeatedly warns not to do this. Everyone needs to find their own method for trading and Ross’s low-float, high-speed technique is not for everyone. I used to play a lot of fast-paced video games and his method works fine for me. As far as I can see, there’s no fraud here. He livestreams his trading sessions.. what more proof does one need? It’s all verifiable. In my opinion, if you see a “scam” taking place, it’s because you’re looking high and low for evidence of it. What one thinks, one seeks to prove (confirmation bias). His trading philosophy about emotional control and mindfulness is also appreciated.

There are two, and only two possibilities regarding Ross Cameron and his alleged gains. He is either an absolute fraud or he is undoubtedly the greatest trader in history. On June 10th and June 1th, he claims to have made nearly a quarter million dollars, day trading. In two days. Nearly $250,000 day trading for a few hours. My desire is simple. Please, SEC, investigate him. If he’s legit, we will build a statue to him. If he’s a fraud, he should be perp walked out if his county farm house, straight into the big house. Do I expect him to be investigated? Of house not. The authorities don’t care. And even if they did, they could nab Madoff, even when he was hand delivered to them. If Cameron were just bragging at the local bar, who cares. But he’s selling super-expensive courses to people who believe in him. People who are inexperienced but are willing to risk tine and money to get their share is the American dream. Again, if Cameron is real (which I highly doubt), I’ll be the first to pay him homage. But if he’s a fraud, it’s one of the worst things I’ve ever seen. Please, SEC, so your job. You have the manpower; the resources and the mandate.

When you risk big money you win or lose big money. Those days where he was making big money, he risked a quarter of a million dollars, give or take, on a few of those trades. Hes experienced enough to read the charts in a way where he recognizes with a very high percentage when stocks will spike up. It just is what it is. He just has the balls to risk very large amounts of money at certain times. If he had made the very same decisions while trading BUT had only risked 5k or some small amount like that, hed probably only would have made a few thousand on those very same days. PLENTY of other traders made those same decisions on those days but risked tiny money. They didnt stand out like Ross did because they only made tiny gains comparatively. Whats so hard to understand about this? Also there have been days where he LOSES 10k or 20k or something like that. Why does no one here mention any of those days? And no this is not Ross or anyone even affiliated with him. I never bought his program (yet). Just a long time Youtube follower. I am in no way gaining from defending him on here. Just thought Id make that clear.

the stocks spike up after he firstly goes long on a low float stock …and then tells the room he is gonna go long and gives them exact figures eg..from 2.10 through to 2:50..

all those guys at home get a delayed feed and get in even at 240…and he is dumping his stock on them as they maintain th price….

he then says im out…and stock price always drops…and then once he is out ..it always goes red red red…ALWAYS.. which is his students alos getting hout..

and then the stocks go into sleep mode and no movement whatsoever…becasue he and the room were the only ones rallying hte stock…and him and his room were the only ones selling hte stock.

not only that, but you can see he is scammnig…he only takes low float stock…which isnt a giveaway in iteself…but the dead giveaway is the TRADED TODAY VOLUME which is alway slike a coupl eof hundred thousand.

you may see gappers with low float and millions traded today ..and the graph looks great …he wont trade it ..as it may have too much liquidity..for his room to move the stock price..

i have seen him take really terrible charts ..simply because they are low float ..they gapped, but they have still tiny volume….these are the ONLY STOCKS HE TRADES IN HIS CHANNEL…

if he were for real..he would trade gappers, with low float, and wicked chart signals….but no …a key signal for ross is TODAYS TRADING VOLUME HAS TO BE REALLY LOW.

WHEN STOCK DROPS he says im out ..and names off some spurious figure like exactly at the tip of the drop…yet we cant see this is where he actually got out.

another dead giveaway is he will sometimes show his personal trading through that viewer site and he will say i lost 700 , or made 2 grand, or made 1.8 grand…yet when he gets the right stocks in his channel and covid means he has 3000 viewers in his chat room…these wins and losses go from 700 dollar to 235 thousand dollar wins….or 40 thousand dollar losses….oyu see he knows the room is behind him and he is dumping his stock to the room all the time..and he knows he can go 100 grand worth or 200 grand worth ..and on a llow float , LOW TODAY VOLUME TRADED STOCK..he himself moves the market then everyone jumps on it ..about 2000 people all putting about 1 grand in ….thats 2 million push of th eprice and he JUMPS OUT .

no wonder since covid his profits have jumped dramatically from 20 grand max to 330 grand days..

There’s a simple arbiter for this.. whether they are selling anything. Think about it, the greatest of all time peddling $99 subscriptions…

Ross Cameron does release his broker statements. But you have to be a paid member, like me, to access that part of the Warrior Trading website. I can read and down every monthly broker statement from Ross’ day-trading from the past 3 or 4 years.

In other words, you are just a disgruntled trader who doesn’t know what the hell that you are talking about.

Having been immersed in Warrior Trading for the past three years, I have my own criticisms or suggestions for membership improvement. But ignorant false accusations like what you assert are not among them.

Post the 3 years of your brokerage statements and Ross’ while you are at it

Hey there. I have been doing a good bit of research on Ross too. Let me know what you think of this new information since this older review:

What is your opinion of the independent auditing firm Citrin Cooperman (I think they have been in business 41 years and have a clean BBB record)? Here is an audited statement and other info https://support.warriortrading.com/support/solutions/articles/19000096593-does-ross-really-trade-with-real-money-is-he-actually-profitable-do-your-strategies-work- of Ross Cameron. This is the only verified info that I have ever seen from any day trader in the world (I have research over 10 solid years and so far he seems to put up the proof). What do you think of this? Please review it objectively from a fresh mind. I respect your input after you review. I am just curious and I am not for or against either way.

Here is Warrior Trading BBB file https://www.bbb.org/us/ma/great-barrington/profile/online-trading-school/warrior-trading-0261-322093

and here it Trust Pilot https://www.trustpilot.com/review/warriortrading.com

I am just wondering, in light of this, if it changes your opinion or not?

I am still discovering what I want to do with this group but I do feel that he is providing broker statements regularly and even third party audited ones as you see above from Citrin Cooperman.

Let me know?

Greg

What exactly does the verification say? That the note 2 is prepared in accordance with the rules in note 3 and 4. One can :

1.make a note , call it “note 2” and say in it : 2 + 2 = 4, then

2.make notes 3 and 4 which state mathematical rules covering addition of two numbers then

3.hire Citron to issue an opinion whether note 2 is produced in accordance with the rules in notes 3 and 4

4.Citron has no choice but state that in fact, note 2 was produced with accordance with the rules stated in notes 3 and 4

And that is all I see in this ‘verified performance’. There is no broker statements, just Ross’ own statements of how to calculate percentages of some numbers and some account numbers written by Ross. Citron does not state that the ‘verified performance’ is in fact in accordance with the statements ftom any from these brokers.

I don’t trust auditors to do a good job. I’m a private tax accountant and I have friends working in public accounting as auditors. Public accounting business model relies on mass recruiting naive college kids each year and overworking them and underpaying them. Naturally this creates high attrition, but the partners don’t care. They get to keep majority of the sweet audit fees to themselves. All of my friends complained how audit is just so damn boring and meaningless. Fees are compressing too. I’ve heard multiple stories where a lowly staff auditor found discrepancies but were told to shut up so that the firm could continue to get repeat business. Anyone who questioned too much got fired. You can imagine the low morale. There always have been dubious audits and always will be. Look up EY wirecard and Deloitte autonomy.

Ross is one of the most clever shams ever exposed by tradingschools , as Emmett mentioned in the initial review. Back in 2016, when I discovered tradingschools from someone in Ross’ chat room mentioning the review. Ross did none of his current more elaborate tricks. He just had the typical lazy sham of putting up “spreadsheet table” copies on “results” pages, showing he totaled about 100k+ for 2015, etc. And of course it never matched up what people were seeing daily in chat room. With most trades just forgotten or glossed over (losers or scratchs), then when a good trade was hit, it was blurted out on message and alert and highlighted like no tomorrow , of course going for the newer dupes in the room to try to entice them to buy the worthless “warrior pro” course always discounted in whatever season of the year , every year. (back then it was at “discounted” deal of 2k or so, now it’s “discounted” at 3k+ on “sale”).

But Ross, read the comments here, and responsed and schemed. And started putting up at first dummy faked “broker results”. When that didn’t work, he started putting up dummy live temp accounts, and promptly pretending he was always withrdrawing to keep the account small , around 30k. while he could do a shell game of both a live dummy account and whatever sim accounts. One time, he screwed up and I screenshoted his fake sim window, obviously was going to use that as a good “live” reported trade later on, if his other dummy accounts didn’t pan out for a “good record”. I think he even did a video showing clicking on the broker site to see a statement, but a hired programmer could feasibly mock up a fake local intranet server site with mockup dns pretend website address resolving on the web browser, incl. using aliases, etc. Also, he was doing the new tricks in response to the comment here back in 2017, 2018, so those “audited reports” links reported on the site you linked, I find to be really dubious, because I was there in 2016 when all he had was a dummy table posted which he erased soon enough from the site by 2018. I think what Ross does now is use multiple live accounts and sim. And has probably perfected his pump’n’dump scheme on his many followers in the room. And probably some of the live is done through different entities or collaboration with some brokers like Lightspeed which now features “beginner intro trading videos” by Ross on their website, ick.

Also important to remember, imo, before the tradingschools organization got bigger and flushed with dupes’ money , it probably couldn’t afford to do the pump’n’dump scheme nor have enough uninformed followers to push the stock up after Ross had already earlier entered. Around 2018 and before, he had no reports of this kind of “$1 million” success, so what about all those duped victims of Warrior from 2015 to 2018? Also “trustpilot” can’t be trusted as you can see in Emmett’s review of it. It’s been practically bribed/bought out by Warrior, as well as Emmett’s comments about IP filtering of testimonials by Ross on the site. Ross has had a long history of being a chatroom mod and fake liar. One example was his old site setup which worded his fake claim of having been an architect. Also Emmett exposed , linking to archive, that Ross was at one time a mod for Jason Bond without his glasses and beard. Ross had archive erase all traces of the warriortrading site, but Jason Bond couldn’t be bothered to have archive delete all cache copies of his older jasonbond site which shows a pic and blurb of Ross, lol. So , take away all those dupes following helping his pump’n’dump scheme, all his tricks, and then could he trade his way out of a paper bag to pay next months’ rent or mortgage on his own with no followers, coming from a sordid history of clever shamshow trickery? imo, nah.

Well, this is a trash review, Ross has ample amount of evidence showing his statements and showing his strategy and yet this BIAS article just goes to show you that there are petty people in this world that don’t want other people to become traders because they don’t feel like sharing the pot. Typical

“petty people in this world that don’t want other people to become traders because they don’t feel like sharing the pot”

The “pot” grows with more “traders” throwing in their money. Do you really believe that’s why someone would be critical of Ross?

This author spent an extraordinary amount of time to post a very long article about a day-trading business (Warrior Trading) that he has little firsthand knowledge of, by his own admission.

It appears that the author attended a free intro lesson; joined the chat room for a couple of days; and then harassed Ross Cameron endlessly.

No wonder Ross Cameron ignored him. I likewise would ignore emails from somebody who is this obnoxious.

The author doesn’t even have his facts straight because Ross Cameron does disclose all his day-trades. His websites post all his monthly broker statements. You can’t get any more authentic than that.

The author is also confused about slippage as it pertains to low-float stocks. He neglects to mentions that Ross Cameron only day-trades ones experiencing high relative volume. Big difference.

Warrior Trading is priced higher than equally good competitors, but only because Warrior Trading was the original and had a monopoly on day-trading courses, for the longest time.

But just because Warrior Trading is priced high does not make them fraudulent.

It, therefore, was libelous to accuse Warrior Trading of fraud because the accusation is a reckless intentional misrepresentation of known fact, on the part of the author.

I completed the Warrior Pro course, and I have been associated with Warrior Trading as a customer for three years. So that puts me in a better position to judge Warrior Trading than this disgruntled author.

Thanks for taking the time to comment, George. I really appreciate it. Most people would not take the additional step to explain their side of the story.

I have a couple of gripes with Ross. The first gripe is that the success rate of students cannot be very good. I base this upon the fact that many of Ross’s ex-students contact me and complain. So I hear the worst of the stories, but not so much of the positive aspects. That’s why your opinion matters…because it gives a more balanced perspective.

The second gripe I have with Ross is that many of the students will attempt to replicate Ross’s trades. They mistakenly believe that if they have $500, and if they just copy and paste Ross, then they should be able to also replicate similar results. But there is the problem…he only trades ‘long’ penny stocks that are very low float (not much inventory) therefore the students that attempt to replicate Ross are usually emptying their trading accounts directly into Ross’s trading account.

Now, in all fairness, students have other options, they can trade with Mike. He trades big names with high volume for longer time frames. But that only leads to the next question…where is Mike’s trading record?

Additionally, I would like to add that I have interviewed two people that learned from Ross, and are now trading full time. So some credit is deserved.

Also, Ross is a very charismatic person, and it’s obvious that he really cares about his students. I enjoy his videos as much as everyone else.

And finally, you gave me legal advice. I appreciate that. But rest assured, my wife is my attorney, and Ross knows full well that everything that I post is well defended, by her.

With that being said, Ross is a big advertiser on TradingSchools.Org. His ads are all over the place. And the simple truth is that his ads are an important source of revenue. In the end, Ross just has to deal with differing opinions. And surely he should be able to agree that my aggressive watchdoggery on this shady industry is needed. Really, without my website, there is nobody else watching out for small traders.

Once again, thanks for your opinion and taking the time to comment. It is much appreciated.

If you know anything about statistical analysis, then you know that Warrior Trading students “who contact you” is a flawed sample pool.

That is because the only students who would contact you are ones motivated by disappointment. That represents a biased segment of the Warrior Pro student population.

The “silent majority” of students, who do not contact you, are going to be those students who are profiting by the Warrior Trading method. And the reason that profitable students do not contact you is because they have nothing to complain about.

Warrior Trading itself has repeatedly done statistical surveys of its students to discover their profitability. Over 80% who completed the Warrior Pro course report being profitable. The remaining 20% are not necessarily unprofitable. Many of them simply lose interest.

Warrior Traders who lose money are those who think that they can day-trade profitably by mirroring what Ross does in the chat room without taking the course.

Big mistake because Ross himself warns chat room attendees not to mirror what he does. That is not what the chat room is for. Your own analysis of the chat room reveals that you don’t understand what the chat room is for, either, because you never took the course.

Also, there is no “pump and dump” as you contend because:

(1) Every chat-room participant knows in advance what the trades will be because the Watch List is created before the opening bell.

(2) Ross only trades stocks that have spiked in Relative Volume before Ross takes a trade. Indeed, the spike in volume is how Ross finds these stocks! So, you are incorrect to contend that Ross is the trader who is causing a volume spike.

(3) Small trades of no more than $25,000 each, among a few hundred chat-room attendees, are not going to influence the price for stocks being traded in millions of shares. You simply have not done your math, if you believe otherwise.

And had you taken the Warrior Pro course, or its equivalent, then you would know that “pump and dump” applies only to Over-The-Counter (OTC) stocks whose volume is so low that price can be influenced by unscrupulous traders. But Warrior Trading does not trade OTC stocks!

Your assertion that Ross Cameron does not prove his profitability is also incorrect because Ross shares copies of his monthly broker statements. A trader cannot be more open and honest than that. And yet, you accuse Ross of non-disclosure, anyway.

Despite all-the-above, don’t get the mistaken impression that I am an adamant defender of Warrior Trading because I have my share of complaints, too, despite my success.

But at least my complaints about Warrior Trading are factual because my complaints are based upon firsthand knowledge that comes from being a customer of Warrior Trading for three years and from being a graduate of the Warrior Pro course.

There indeed exists shortcomings to the Warrior Trading method. But you only cite misinformation, rather than legitimate issues of substance, because you don’t know what the legitimate issues are. It is because your firsthand experience with Warrior Trading is so limited.

I don’t believe you are intentionally dishonest. It seems more likely that you are instead misinterpreting what you observe because your knowledge of day-trading is that of a beginner who has read about day-trading but otherwise has no firsthand experience at doing it.

Be assured that there are people who do earn impressive incomes as day-traders. They consistently profit thousands of dollars per day, using the Warrior Trading method or its equivalent.

If it were not so, then the IRS would not have a provision for “Trader Tax Status” (TTS). But the IRS does have such a provision, and it is because there do exist day-traders who profit by hundreds of thousands of dollars per year, just as Ross Cameron does and so do his successful students.

This will be my last post about Warrior Trading. For one thing, the primary purpose of my visit to this website was not to read about Warrior Trading or to comment on Warrior Trading; and these replies have already consumed a disproportionate amount of my time, where I get nothing in return for my time. Bye.

why don’t you post your track record? And perhaps have it verified, not just written by you.

Hi Emmet, Thanks for this review it’s very helpful and totally agree with you that I never see his hands move to do his trades so am sceptical as well whether he live trades.. But please what does DOM stand for? I googled and could only find “Depth of market”? Is that what you mean by DOM? If so he does show the level 2 windows in the videos that I watch…if you could clarify it, I’d appreciate it. Thanks

Ross posts his monthly broker statements, going several years back. What more evidence of live trading do you need than that?

Sounds like you got burnt and are full of shit. Maybe I’m wrong…

If anything he is making money with selling the classes and making a flat fee on each “sponsored student” from the multiple brokerage platforms. Lightspeed….CMEG…and a few others

Maybe that’s something to look into

Hi Emmett

Time for a follow up? https://media.warriortrading.com/2019/10/Audit-Page-2.png

Maybe they are counterfeited?? Maybe Lightspeed is in on it??

Lets go Emmett!!!!

What exactly does the verification say? That the note 2 is prepared in accordance with the rules in note 3 and 4. One can :

1.make a note , call it “note 2” and say in it : 2 + 2 = 4, then

2.make notes 3 and 4 which state mathematical rules covering addition of two numbers then

3.hire Citron to issue an opinion whether note 2 is produced in accordance with the rules in notes 3 and 4

4.Citron has no choice but state that in fact, note 2 was produced with accordance with the rules stated in notes 3 and 4

And that is all I see in this ‘verified performance’. There is no broker statements, just Ross’ own statements of how to calculate percentages of some numbers and some account numbers written by Ross. Citron does not state that the ‘verified performance’ is in fact in accordance with the statements ftom any from these brokers.

I don’t trust auditors to do a good job. I’m a private tax accountant and I have friends working in public accounting as auditors. Public accounting business model relies on mass recruiting naive college kids each year and overworking them and underpaying them. Naturally this creates high attrition, but the partners don’t care. They get to keep majority of the sweet audit fees to themselves. All of my friends complained how audit is just so damn boring and meaningless. Fees are compressing too. I’ve heard multiple stories where a lowly staff auditor found discrepancies but were told to shut up so that the firm could continue to get repeat business. Anyone who questioned too much got fired. You can imagine the low morale. There always have been dubious audits and always will be. Don’t believe? Look up EY Wirecard and Deloitte Autonomy. Remember Arthur Anderson and Enron? There are countless more audit scandals that never come to light.

If you rip warrior trading so bad, why are his advertisements all over your site?

Because I need Ross’s advertising dollars to keep this stupid blog alive.

Truth be told, I could write plenty more about Ross, but in some perverted economics…I also need his ad dollars.

He is a top feeder. I am just a lowly bottom feeder that publishes crappy articles about everyone.

There is an audited account statement on his website.

Your problem is that you followed his trades instead of trading for yourself.

Ross has 1 Million in trading profit fully audited by a CPA firm. There is no higher standard of proof than this.

i can’t see any comments!!!!

Thanks for the heads up. It appears I have a bug in the system and need to get that fixed!

I see a lot of ads from this guy on Facebook.

Heavy advertising on fb

I dont know. This guys seems legit. I think the SEC would have stepped in by now if he was scamming people.

Have you reviewed his record here – https://www.warriortrading.com/verified-earnings-2019/

I think that Ross is an amazing marketer. There are also a few other things that I admire. He has managed his business very well. Additionally, he has made some extraordinarily tough business decisions regarding whom he is willing to work with.

I watched him dump an old business partner that was causing problems (that was not easy). I watched him dump a few Warrior Trading members that ultimately became successful traders, yet they began to siphon away business with their own ventures.

He can be ruthless and nasty at times. But he does pay his personal and legal debts when he loses and makes poor decisions.

Now…about his trading. At this point, pretty much everyone on the internet knows how the Warrior Trading chatroom actually works. It’s plainly obvious, to anyone that understands how markets function, that he is front running the subs. Everyone is attempting to replicate his trades, which creates a situation where he can easily enter and exit trades, while everyone in the chat room is stuck paying ever richer prices.

Ross is playing every hand with 5-cards, while the subs are playing with 4 or 3 cards. They are at a disadvantage. I hope what I am saying makes sense. But it probably does not.

Additionally, when things dont work out at Warrior Trading…I am the one person that people usually email or telephone with a grand sad tale. I hear the same story, over and over and over again.

Day trading is nearly an impossible endeavor and you are virtually guaranteed to lose everything. But the lust to get-rich-quick is such a powerful emotion.

So my advice? I recommend that you buy the whole Warrior Trading enchilada. Gulp it down and let it swirl around your entrails for a solid year (assuming you don’t blow up your account) and then give me a call in a year. And then we can review the experience.

“I watched him dump a few Warrior Trading members that ultimately became successful traders, yet they began to siphon away business with their own ventures.” – but I thought he was a fraud? how are his students becoming so successful that they’re taking away business! lol

I see no evidence that any Warrior Trading critics here have paid a subscription fee and participated at WT for any length of time. For one thing, none of you say that you have.

I have. Plus, I have completed the entire spectrum of WT courses and participated in the chat room.

From my perspective of firsthand experience with WT; I can tell that none of you WT critics know what you are talking about. You all just sound like a bunch of wannabe day-traders who tried your hand at it, but failed.

What I read here are all the tired wornout myths about day-trading that are proffered by critics who know nothing about day-trading.

I wish this website would stop sending me email notifications because reading and responding to posted misinformation about WT grows tiresome.

Well, WT’s hitman coming back again to convince us that pigs fly