Woodies CCI

-

Honesty

(1)

-

Quality

(1)

-

Cost

(1)

-

Support

(3)

-

Verified Trades

(1)

-

User Experience

(1.5)

Summary

Ken “Woodie” Wood has been selling his magic CCI trading indicator since before the millennium. He is lovable, doddering old indicator hustler. He claims to have a 40 year history of trading successfully. However, there is scant evidence that supports that Ken “Woodie” Wood has ever earned a profit trading any security, whatsoever. After many attempts, and requests to validate his personal trading, Woodie simply refuses to verify his own personal trading record. However, Ken “Woodie” Wood is more than willing to allow us to spend ourselves into a financial oblivion with is mega menu of magic trading indicators. Absolute waste of time.

User Review

( votes)Thanks for reading today’s review of Woodies CCI

What is Woodies CCI? Woodies CCI is a group of trading websites that specifically market different variations of one very simple trading indicator, the CCI or Commodity Channel Index. The indicator, according to Investopedia was originally developed by Donald Lambert, whom had written a book on the indicator back in the 1980’s. What many readers do not know is that the modern technical analysis movement got its explosive start back in the 1980’s. Why the 1980’s? Because this was when personal computers became cheap and readily accessible to the average consumer. And of course, humans will naturally gravitate towards what they have naturally done since the dawn of time, attempt to GET RICH QUICKLY.

Many of these computer newbies quickly discovered that they could standardize stock and commodity pricing data in ASCI files and then create all sorts of mathematical outputs with their home PC’s. These calculations of pricing data started off as simple moving averages, then became progressively more and more complex. One of the most famous of the 1980’s era was Wells Wilder. Look at any modern technical analysis platform and you will surely find Wells Wilder’s Parabolic, Average True Range, Relative Strength Index, etc. I am sure that many of you reading this are already aware very familiar with many of these common trading indicators.

The sad and simple truth about us traders is that we can easily become obsessed with technical indicators. We never stop searching for that one “Magic Indicator”. There is no end point, the deeper we search, the stranger and more esoteric the journey becomes. Wells Wilder, after he developed most of his math based technical indicators, which eventually were debunked, delved into some ultra wacky theories namely “The Delta Society“. Through the use of astrology, Wells Wilder claimed that he “could and would always predict every market turn, in any market, with amazing accuracy. All through the use of planet and moon cycles”. At one time, the Delta Society indicators sold for over $100,000 per user, however they can now be purchased for $75. No kidding. Ok, let’s talk about CCI…

The CCI indicator is quite simply nothing more than a child of those wacky years when technical analysis was in its infancy and everyone was attempting to cash in by creating and selling the latest and greatest math based, magic trading indicator. At that time, it was considered to be new, fresh, amazing, used intense mathematical calculations and somehow these fancy math calculations would be able to predict the future and unlock the riches of the financial markets. A lot of people bought into the story, until computing power once again expanded and allowed others to test these math based trading theories.

Backtesting Software

During the early 1990’s, a new breed of computing programs began to hit the market where a user could take the most popular technical trading indicators from the 1980’s and then back test these highly popular indicators against real time price data. One of the first and most successful companies to offer this back testing software was Omega Research, now known as TradeStation. The owners of the company, Bill and Ralph Cruz, a couple of traders just like you and I, were curious if any of these amazing trading indicators developed during the 1980’s could really predict the stock and commodity markets. And so they developed a program and a programming language where the trading newbie could in fact test a multitude of the most popular trading indicators. Bill and Ralph Cruz quickly realized that the industry was rotten to the core and decided to mass market their specialized software that debunked these wacky trading ideas. The software quickly became very popular.

By the mid 1990’s, pretty much anyone within the retail trading space that had enough courage to learn how to program trading strategies was beginning to learn the truth about technical indicators…they are not predictive beyond the random threshold. Nearly every single technical indicator is quite simply a fantasy of the minds conjuring. Smoke and magic where we place a higher emphasis on when the indicator is correct, and a lower emphasis on when the indicator is not correct. We look away when our wife or girlfriend stares longingly at the younger more handsome man, but we stare intently and highly emphasize when she serves our favorite meatloaf casserole. When the indicator is correct, the minds reward system greatly exaggerates the positive experience. But when the indicator is wrong, we look away, afraid to accept what we choose not to see.

As many of you reading this already know, there is a Chinese army of indicator salesman willing to take our money, and boldly proclaim to know which way the market is going in 5 minutes, 5 hours, or 5 days. For a one time special price, we can easily purchase these magic trading indicators that unlock the riches of the universe. For just a small monthly fee, all of our financial problems are a thing of the past.

I have written extensively about these indicators hustlers, in their many shapes and varieties. The one thing they all have in common is that they never can produce an account statement showing any profits from their magic trading indicators.

Woodies CCI

Ok, so now I have finally gotten to the part about Woodies CCI. Why not just begin this review by simply talking about Woodie? Because you really need to understand the history of the CCI, and the swamp that this Woodie character crawled out of. Ken Wood, aka “Woodie” is just another indicator salesman. Selling the dream to a bunch of naive newbie traders since 2001. This flim flam man has been around, selling the trading dream since Pacman was popular. Woodies hustle is selling that old, tired, and thoroughly debunked CCI trading indicator with a lemony twist. Not the original CCI, but Woodies own special blend of magic CCI lemony twist bullshit. In fact, he created a worthless set of DVD’s that can be purchased for $195. Why do I say worthless? Because the very moment that his strategies are programmed and tested, a person will quickly realize that his trading indicators simply do not pass beyond random output. In other words, its just more worthless dribble from yet another market fortune teller that has no scientific evidence to support his claims.

Ok, so now I have finally gotten to the part about Woodies CCI. Why not just begin this review by simply talking about Woodie? Because you really need to understand the history of the CCI, and the swamp that this Woodie character crawled out of. Ken Wood, aka “Woodie” is just another indicator salesman. Selling the dream to a bunch of naive newbie traders since 2001. This flim flam man has been around, selling the trading dream since Pacman was popular. Woodies hustle is selling that old, tired, and thoroughly debunked CCI trading indicator with a lemony twist. Not the original CCI, but Woodies own special blend of magic CCI lemony twist bullshit. In fact, he created a worthless set of DVD’s that can be purchased for $195. Why do I say worthless? Because the very moment that his strategies are programmed and tested, a person will quickly realize that his trading indicators simply do not pass beyond random output. In other words, its just more worthless dribble from yet another market fortune teller that has no scientific evidence to support his claims.

Is calling Ken Wood “Woodie” an indicator hustler and a market fortune teller really a fair description? In my opinion, absolutely. For years I have watched this guy appeal to the newbie trader and frustrated trader alike, conveying to the audience that if this nice old guy can do it with his magic indicator, then so can you.

Woodie loves to portray himself as this harmless, paternal, grandfatherly type guy, just a lovable guy looking to help traders be successful. He loves to pepper his

Woodie loves to portray himself as this harmless, paternal, grandfatherly type guy, just a lovable guy looking to help traders be successful. He loves to pepper his website with pictures of Woodie standing next to Barbara Bush and Alan Greenspan, conveying his implied connections and personal admiration’s. Also included on page one of his website are links to the CFTC and the SEC, where traders can file complaints against

website with pictures of Woodie standing next to Barbara Bush and Alan Greenspan, conveying his implied connections and personal admiration’s. Also included on page one of his website are links to the CFTC and the SEC, where traders can file complaints against

those bad people, selling shady trading stuff. Its all a red herring. The inclusion of these visual markers are quite simply, nothing more a distraction from what is outrageously obvious. And the outrageously obvious is quite clear, there is nothing published that talks about Woodies own personal trading performance. Does Ken “Woodie” Wood even trade? Does he even have a funded trading account? Does he have any sort of verifiable track record? Is there any proof that for the past 40 years this guy has ever made an annual profit? Hello, anyone?

A lot of you are going to be pissed off at me for going after the lovable Woodie. He reminds us all of our beloved Grandpa. We all trusted and loved grandpa. He showed us the proper usage of sand paper, and how to tie a knot to a fishing hook, and how to say thank you and be a cordial person. Yep, I loved my grandpa just as much as you did. But for just a moment, lets gets tough on Grandpa. Lets trip him at the top of the stairs. Lets hide his dentures for a day. Put his eyeglasses in the refrigerator. Let the dog run off with his hearing aid. Lets get tough on old Woody and try and figure if this trading grandpa has anything beneficial to offer to the trading community. The only way to know for sure? We need individual trading performance from Woody.

Trying to discover the truth about Woodie

For the past three months, using over a dozen aliases and multiple angles of inquiry, I have attempted to answer this simple and incredibly basic question…does Woody even trade? The first step was a series of emails directly to Woodie, simply asking for proof of trading results. After being repeatedly ignored, Woodie will finally respond and direct any interested person towards one of two different trading products. The first would be Woodie’s $99 a month chat room. Any live trading in this room? None. Instead, its a mosh pit of chatter from people that purchased the DVD’s or are currently spending $199 per month for the magic indicators and may or may not experience consistent success, and so they need more help, guidance, training, etc. What these newbies really need and want is to watch the master trade himself. And Woodie is more than happy to oblige…for an additional fee.

To see Woodie put on live trades and pull profits out of the market, using Woodies CCI indicators. A person would then need to purchase a live trading signal package that costs between $800 and $1200 per month. Yes, its expensive. And Woodie puts a cute little trick into the pricing plan…you don’t pay for the symbol, on any particular day that Woody loses money. This might sound like a great deal, however upon closer inspection, a person with a brain the size of a Spanish peanut can quickly ascertain that they are accepting all of the risk and Woody has zero risk. Woody flails away inside of his trading room, using only a simulator, trying to produce a winning day with various simulated trading symbols. No risk to him, while you are trying to replicate Woodie’s limit orders. And we all know how limit orders can be manipulated.

Does Woodie have a track record for his live trading room? Absolutely not. After multiple attempts, the best that I could produce was a garbled series of emails that say things like “got some winners this week”. Or a random picture on twitter that supposedly showcases how much money he is making. Really Woodie? The best you can offer is a random tweet every 3 months? Where is the spreadsheet of trades called inside of your trading signal service? You want the trading community to risk our hard earned money on your magic trading indicators and your carnival pricing plan, yet cannot even afford us the most basic dignity of disclosing a trading track record? Amazing stuff folks. As I watched this Woodie character operate inside of the trading room, I simply could not believe that any sane minded person would fall for this doddering old huckster.

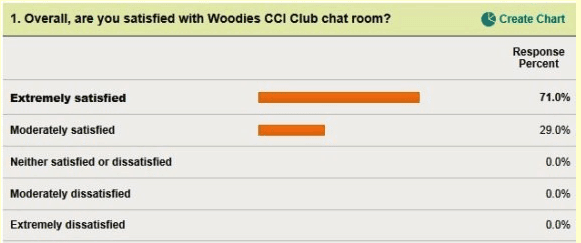

Does Woodie offer a free trial? Heck no! Instead he refers potential purchasers to a customer survey that claims that “100% of his customers are satisfied”. This is about as credible as the time that Saddam Hussein got 100% of the Iraqi vote and had a 100% approval rating. Really Woodie? 100%? Why not 110% of your customers are satisfied?

Wrapping Things Up

A lot of readers are going to dislike that I really got after old Woodie. He is sort of a beloved trading character within the trading community. However, anyone with the drive and focus can very easily program all of his magic CCI patterns. Once you actually spend the time and hard work of coding and testing, the truth becomes readily apparent. And the truth is that the CCI indicator, which serves as the basis of everything he is selling, is nothing more or less predictive than a random number generator. Once you do the hard word and run the tests, you feel betrayed by Woodie. The perception of him changes considerably and we begin to ask a new series of questions.

I have also given Woodie more than enough opportunity to provide some sort of proof of his supposed, amazing trading abilities. However he simply refuses even the most minimal form of performance disclosure. Instead, he is hoping that we will continue to fall for his “trusty grandpa” routine. Well, Woodie I have been writing these reviews for over a year, and I have yet to find even a single person that I would outright trust. In fact, without the presence of a verifiable track record and permanently displayed trading DOM, then the vendor is very likely just another indicator salesman, looking for the next sucker.

And Woodie, your moniker of “Traders Helping Traders” as far as I am concerned is pure BS. Its about time someone has faced you front and center, and directly challenged you. Forced you into a corner where you can put up, or shut up. Nothing would make me happier than to come back in 30 days and draft a new review. A review that reflects at least some portion of your, supposed 40 year trading career. But something tells me that this is not going to happen.

Well that’s it for today. Writing about Woodie gave me no joy whatsoever. In fact, I found the process to be painful. Why? Because, in this world of never ending con games, chicanery, and petty hustles…we always like to somehow believe that the eldest among us are the most honorable and trustworthy. That their age and collective wisdom somehow insulates them from greed and avarice, however I have not found this to be true. Which is pretty sad. Thats it for today, please leave your comments below. And I really want to hear from the “Woodie Fan Club”, the comments section should bring some fun exchanges.

Thanks for the article, I appreciate the accountability leveled at the trading con artists out there.

Now while you’re at it, have you ever assessed the con artistry of Bill Mcready’s magic futures system and also Todd Mitchell’s Emini package? I lost two grand on 2 completely bullshit, phony methods. I called up Mitchell once whose website pushed his 24/7 “expert availability” and asked him what the conversion was between the emini, and the emini dow (what is 1 point on the emini when applied to the emini dow). And he couldn’t answer that basic question. I once called Mcready to ask why his “live” results always looked “perfect” but mine were losing money. “Ill get back to you” he said because he “was in the gym”. By the way, his course was so poorly written – misspellings, grammar mistakes, childish use of language – that a 3rd grader would write better. And this guy was supposed to be an engineer or something.

Its time the trading community start policing these flim man confidence men for what they are.

Todd Mitchell, oh wow, that dude has been selling stupidity for eons. It’s all he knows.

I will have to do put Bill McCready on my list of reviews.

These fakers drive me crazy.

can you put name on your maillist

ty

There was a man in Woddie’s room back in the day – Dr. Famir. He was rah rah Woodie all the way, and a wealthy retired surgeon. Woodie even names one of his CCI setups after him. A few years later, Dr Famir was found dead – suicide. It turns out he lost ALL of his money trying to trade the CCI and couldn’t live with himself. Woodie told the room that he died of a heart attack. So sad.

http://tradersparadise.blogspot.com/2008/03/woodies-cci-club-and-very-sad-dayvery.html

“Traders helping traders” …for a small fee. Just send $60 to Tim’s PayPal account for a 45 minute consultation.

“Everyone knows how limit orders can be manipulated” Except me, I guess. How are limit orders manipulated?

ugh, why is this reviewpage asking for a “woodiescci” browser certificate?

I sure hope it’s an artifact due to the link to woodies’ page and nothing to do with TS!

Speaking of POS scam artists…I think Emmett takes the cake. Nice Job Emmett on this rave review of just how trustworthy and honest your endorsements are…who’d listen to a fraudulent con artist such as yourself…just idiots who can’t think for themselves.

http://tradingschools.info/2015/08/05/a-review-of-emmett-moore/

I tested all indicators. My conclusion is none of them make money. Only the inventors do.

Welles Wilder lost over 100000 on his indicators. He made millions on his books. He ran out of usa.

Yep, I spent too much time at the woody room. THe best was the PFG best account I had that got ripped. When in Arizona I met woodie. The free room had some good ideas for the newbee. Day trading futures is one the most difficult things to do. I’ve started businesses, had corporate manager positions, bla, bla bla. But the conceptual freedoms of a trading career is second to none. The allure that we aspire for is so great we attract the parasites into our pollyanna world. Anyone that says this trade is easy is a liar, straight up. In the trading world woodie thought he was “revolutionary”. Bullshit has been around for thousands of years. So has greed, lying and cheatin.

You really “get it”. Great comment.

Yes E, it is easier to GET when you are eager to “Get Got” especially when it has slapped you upside the head. Sorry for our monkey brains that we need several slaps to start paying closer attention.

One out of every 25 peeps is a sociopath. Seems like your reviews find 2 out of 3?

Hat tip to you and be careful you don’t get too close and get got, too.

http://www.elitetrader.com/et/index.php?threads/is-woodie-a-fraud-yes.64819/

The guys on elitetrader.com did a hilarious job on woodies room around 2006. I am amazed he is still running

http://tradersparadise.blogspot.com/2008/03/woodies-cci-club-and-very-sad-dayvery.html?showComment=1205755620000#c4886817856616249280

Sad story about the “famir” pattern. Only found out about it through a comment on forexpeacearmy. http://tradersparadise.blogspot.com/2008/03/woodies-cci-club-and-very-sad-dayvery.html

Hello traders,

i was a newbee in his room “traders helping traders” back in 2004.

It was free of charge and a good resource to learn about daytrayding, with all the good people moderating the room for free and for children-Charity.

I have spend money also in these days.

Mr. Woodie told the crowd that he spends money from seminars for children, but many people told later, that he took the money for himself.

Of course, i was not succesfull with his so called woodies-system and i had to go back to work in 2005 to earn money.

Today i am a swing trader and i still use the woodie CCI pattern as an indicator to confirm trend-changes (“Ghost”-pattern) and pullbacks (“zero-line-reject”-pattern).

His(?) Indicator “woodie-CCI” is still for free availible on Ninja-Trader.

Even then he was a kind of a weird guru………….

Great article to show his real personality.

That`s the way it looks from here in Germany (sorry for my bad english)

Tom

I was on Woodies site maybe a dozen years ago. I dont think he is a hi rolling trader, but propbably trades successfully? who knows. The CCI is actually a decent trend indicator very close to the Detrended Oscillator. Dont discard it

I sat in Woodies trading room a few years ago and quickly realised just how much of a scam it was.

The indicators have NO positive expectancy and if you question Woodie he becomes very aggressive and abusive.

My advice is to stay away and keep your money.

I used Woodies chatroom years ago, when it was free and before it became extremely famous. I like some of the simple CCI-pattern and i believe, they are still good to organize your day trading. When everything was simple at Woodies Club, it was a pretty good start to learn some basics for day trading. But over the years the entire community turned into a weird, complicated, confused and very expensive and useless circus.

Carsten,

You became a better trader, and that only made you see what was already a circus.

Grampa needs a smackdown.

Woodies CCI.

LOL.

If you were stupid enough to buy into this garbage, you deserve what you got.

An indicator that can help you trade. LMAO. What truck did you just fall off the back of?

So Glad you nailed Grampa .

For years this clown has been fleecing people selling completely worthless software

He does the equivalent of taking Windows 3.1, change the logo, and call it Windows 10.

Then the bastards upsells you to turn on Notepad, Calculator, & Clock, even though its there, but may not be in plain sight.

I remember he would pop into the Think or Swim chat rooms and start peddling some dopey auto-trader .

Not sure why he never would get booted doing that, most others did.

Great review Emmett. You certainly nailed it perfectly.

Thanks.

He plays the Grampa role to perfection. Nobody wants to be mean to Grampa. I just thought, ah fuck it, Grampa needs an undressing just like the rest of these indicator hustlers.

Emmett thanks for this review. I remember this guy back in the paltalk days and people would swoon over him like he was the coming messiah … I never fell for his bs. I wad lucky to be able to see through it.

some of theses seniors have tried to mold themselves similarly as to-nice-to be-mean-to woodie-grandpa’s. namely simmer-indy-sellerFelton, “almost on SSI” plastic mutilator Sachs, mr. rodgers Brooks, and “trade of the day” ninjaindicators4u.com, and count carnival shot “raise indicator price after TS review fades” TraderHelp!Desk GailMercer grandma too.

Indicators work, if it’s simple and understandable.

You want a real indicator fruadsta, look at Rob Booker:

* Trifecta is the gift that keeps on giving (to Booker that is!)

* He’s pure entertainment, brakes his own rules and has no discipline, he jokes about everything!

* He’s pure marketer, he always has something to sell, at every price range 20-500

* He loves traders, lol he loves suckers!

Back when I was first trying sim trading on metatrader I tried one of Mark McRae’s forums. The membership included an “educator” who did occasional webinars where he traded a variation of Woodies CCI. He even Woodies CCI as background to look into. When I asked him which broker and platform to try, he recommended PFGBest and Genesis Trade Navigator. I noticed on occasion he would show his platform and it looked nothing like the trial I had on Trade Navigator which looked like it was still made for Win98/ME so I went to something else. A year or so later was the PFGBest fiasco. Glad I missed it. I should note Trade Navigator was owned by a relative of a member of Rockwell Trading, a dubious educator and trading room that probably needs to be reviewed here eventually also. The “famir” pattern of the Woodies setup has a rumored tragedy. http://www.forexpeacearmy.com/public/review/www.woodiescciclub.com

Last I heard, a Woodies defender claimed they were using renko or range bars when their old motto was “we don’t need no stinking price bars!”

Did you have another review which you took down?

Indicators are just that — they “indicate” something, ie, they act as a confirmation of something. The only thing that can make you money is price. And the problem with that for new traders is that it takes a long time to study and understand price. That said, if you study the screen and price long enough you will get a feel for where price is going and then you can really trade. If indicators were the end all/be all, then all the hedge fund algo guys would already be sitting on a beach in the Caribbean. But they’re not, they ‘re at work 15 hours a day trying to eek out the 2% gains that hedge funds consider a good year. I’d be very wary of anyone selling indicators or even using indicators exclusively as the magic way to riches. I’ve been trading for 15 years and it took me a good long time to get to the point where price was the determining factor in my trading. Sorry to rant on, but these scammers selling indicators are just trampling on the new-to-trading people who are being convinced that they can get rich quickly. Emmett, keep up the good work, hopefully you’ll save a lot of people a lot of money.

I was part of a forum where a so called pro trader did occasional webinar on an improved variation of Woodies CCI where he even drew trendlines on the cci which was at different settings than the orginal woodies settings. He even recommended using Trade Navigator through PFGBest at the time. There is a tragedy involving the person of which the “famir” pattern was named after. http://www.forexpeacearmy.com/public/review/www.woodiescciclub.com

I tried for half a year using the setups on sim and could never get it to work consistently.

Later on I’d heard some promoter of Woodies in a forum that said they had supposedly moved on to using renko or range bars when their motto used to be “we don’t use no stinking’ price bars!”

On another defunct forum, there was an occasional webinar host who used the CCI and touted an improved variation methodology of Woodie’s setups. Now, I realized he must have been driving traffic to Woodie. Most every other trading forum out here has debunked Woodie and Woodies’ CCI. Some try other so called innovative ways to “master” the CCI by drawing trendlines on it or changing the settings of the CCI. I spent more than half a year on sim trying to get consistent with the setups to no avail. Unfortunately there is a tragedy involving the “famir” woodie setup. http://www.forexpeacearmy.com/public/review/www.woodiescciclub.com There used to be woodie’s “motto” which was “we don’t need no stinking price bars” or something like that. Since 2012 or so a woodie supporter on a forum tried to say Woodie now taught a side strategy using renko or range bars. It’s also interesting to note that a few popular trading platforms even include the woodies CCI in their default indicator packaging.

I stumbled into Woodie’s HotComm room back in 2004, when it was free.

I think he began with good intentions. Back then he recommended Sierra charts, which were free at the time, and guy called “Kiwi” would code the indicators for Sierra, for free. I didn’t use Sierra, but he used to hold training sessions for the package–since it was such a pain in the ass to begin with.

He used to organize trading events, which had a modest price tag and the proceeds were to go to a children’s charity. I think when he realized how much money could be made from these events, his motives began to change.

Things gradually changed over that year. The room itself had become huge; it was the largest trading room at that time. He began recommending more paid products, like ESignal charts, for which he had indicators developed. There was a fee for the new indicators, and they were developed for ESignal only, so there were 2 revenue streams right there.

Then he began recommending Trade Maven, which was a new DOM platform. Then the brokers started circling overhead. All of the room “insiders” were starting to go on about how great a certain broker was. I think it was a part of Peregrin, but I can’t quite remember. Eventually I was told that I “needed to change brokers”, since I had been a room moderator for about 8 months. A lot of other red flags had been hoisted as well, too many to even get into.

I finally realized that the room wasn’t about trading any more; it had become a channel for delivering naive, hungry beginner traders to expensive services and brokers.

I think most of the experienced traders that were there were just looking for some company during the day, to be quite frank. I did learn a lot during my time there, but mostly from those other traders in the room.

I can’t remember what I was looking for yesterday when I found your site, but I really appreciate your reviews. I was actually going to email you to ask if you had Woodie on your radar. This review nails it.

Great comment. Thanks for reaching out.

My gripe about this industry is that guys like Woodie push their indicators as a “base” in which to build a future trading career. The problem with building upon such a base, or foundation, is that it is essentially flawed. In other words, most people will take Woodies indicators and then proceed to lose money because the indicators are random. Its a frustration revelation. Especially when his trading indicators are tested on real data. Unfortunately, the majority of folks have a difficult time learning how to program and backtest.

I’d be interested in seeing a review/comparison of the different backtesting software products out there if this is something time can accomodate.

It was really hard to ignore when the real insiders stepped up and told me I “needed to change brokers”. They gave no reason, other than PFG was Woodie’s preferred broker all of a sudden; as though my trading account belonged to them.

Thank God you didnt take Woodies advice and open that account with PFG aka Peregrine Financial Group. The owner of that brokerage, Russell Wassendorf absconded with $200 million of segregated customer funds. This embezzlement stole the monies of 25,000 customers across the US. Russell Wassendorf was featured in CNBC’s American Greed, Episode 87 “The Falcon and the Con Man”.

There are a few old pictures of Russell Wassendorf and Woodie floating around. Am not saying that Russell and Woodie were best bro’s, but it certainly does not look good when a trading educator whom is promoting a dubious product is also tightly affiliated with, and highly recommended a person that stole hundreds of millions of dollars from his customers.

I wonder if Woodie writes to Russell in Federal Prison. If a person really wants take Woodies advice and open an account with Russell, then they will have to wait until Russell is released in 2056. At that time, Russell with be 101 years old.

Back when I was first trying sim trading on metatrader I tried one of Mark McRae’s forums. The membership included an “educator” who did occasional webinars where he traded a variation of Woodies CCI. He even Woodies CCI as background to look into. When I asked him which broker and platform to try, he recommended PFGBest and Genesis Trade Navigator. I noticed on occasion he would show his platform and it looked nothing like the trial I had on Trade Navigator which looked like it was still made for Win98/ME so I went to something else. A year or so later was the PFGBest fiasco. Glad I missed it. I should note Trade Navigator was owned by a relative of a member of Rockwell Trading, a dubious educator and trading room that probably needs to be reviewed here eventually also. The “famir” pattern of the Woodies setup has a rumored tragedy. http://www.forexpeacearmy.com/public/review/www.woodiescciclub.com

Last I heard, a Woodies defender claimed they were using renko or range bars when their old motto was “we don’t need no stinking price bars!”

I would also like to see RWT reviewed.