Algorithmic Trading Company

-

Honest

(5)

-

Quality

(5)

-

Cost

(3)

-

Support

(5)

-

Verified Trades

(5)

-

User Experience

(5)

Summary

An excellent, top tier systematic trading company. My most researched and thoroughly documented review to date. A tremendous amount of mental horsepower has gone into these trading algorithms. A very smart developer with high level engineering, math, and programming skills that is offering a true high level performance product. Proven track record. A level of honesty and candor, that in a trading vendor, I had not thought possible. Highly recommended. Excellent customer support.

Today’s review is a trading system vendor named AlgorithmicTrading.Net and MyStockTradingBiz.com. Both websites display nearly identical information. The business is owned and operated by Rich Metzger. The official address for the business is 702 W Idaho Street, Suite 1100, Boise Idaho, 83702. I can confirm the address as a location for executive suites and virtual offices. An actual address is pretty refreshing, even if its only a virtual office. Over the past few months of writing reviews, I have found that the majority of addresses listed by trading vendors are bogus. Some examples would be a vacant lot in Houston, a wedding dress shop in Oklahoma, an actual church in Phoenix Arizona, a swampy field in Michigan, a trailer park in Florida, and a high school. I also found it refreshing that Rich has an answering service for the toll free phone number. The vast majority of trading vendors just default to voice mail, and getting a return phone call is tantamount to getting a wisdom tooth pulled. I made several phone calls to the toll free number, all calls were answered or quickly returned by Mike Webber, the director of sales.

Before I get into the nuts and bolts of what this company is offering, I wanted to take a moment to highlight some blaring irregularities. Anomalies. Weird sightings. Things that you just dont see too often in the trading world. As a matter of fact, I have seen some things with this company that I have never witnessed before. Sort of like seeing bigfoot, a jackalope, a chupacabra, or a fully constructed chicken coop in the middle of my local Costco.

Blaring Weird Sighting Number One

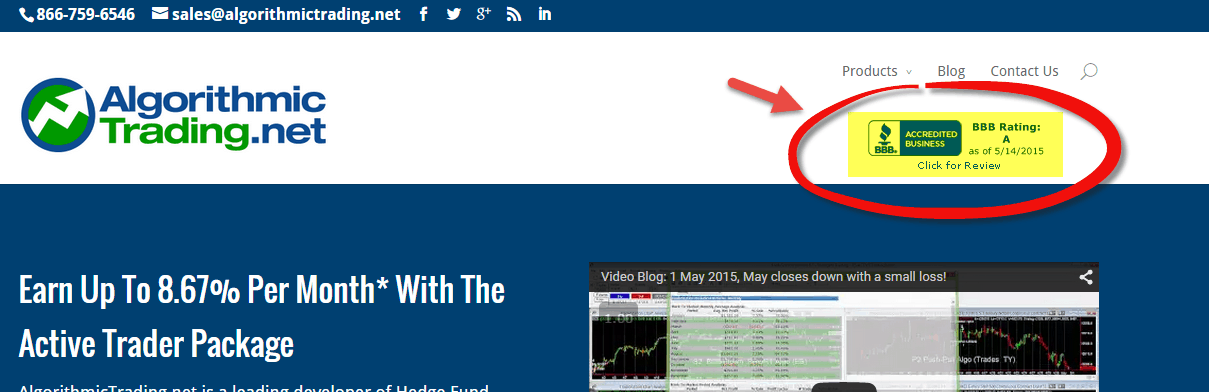

The first thing that I saw on both sites was an official stamp and a link to the Better Business Bureau. I have looked at hundreds of trading products, and this just looked fascinating to me.

This really piqued my interest. I see Better Business Bureau listings for roofing contractors, plumbers, electricians, etc. But I had never seen anyone with a trading product attempt to establish credibility with the BBB. Truthfully, I have known a few building contractors and they all hate the BBB because the BBB always sides with the consumer. The person with the negative BBB review is usually forced into some sort of monetary settlement with the disgruntled party because a negative BBB rating is the kiss of death, at least for a building contractor. The BBB is a consumer advocacy, meaning the consumer’s argument is usually all that matters, right or wrong. Within the context of a trading product, especially a product where the consumer is guaranteed to lose money at some point (all systems lose money at some point), I felt like this was an extremely risky move on the part of Rich Metzger. There is basically no upside to putting the BBB sticker on your website.

And in addition to the BBB being a nearly guaranteed lose/lose proposition to any trading vendor, I also noticed that AlgorithmicTrading.net/MyStockTradingBiz.com are an Accredited Business. What does this mean? This means that Rich Metzger had to fill out a bunch of forms and answer a bunch of questions about who they are and what they are offering. What are those forms and questions? I was curious myself, and so I called my local Better Business Bureau chapter located in San Diego, Ca. I asked them what I have to do get accredited. I was interviewed on the phone, and then sent a bunch of forms to fill out. I felt like I was filling out the intake forms that need to be filled out whenever a person attends a brand new physician. I felt a bit violated. But I filled out my forms, acting as if I had a trading system to sell to the public.

A day later, I get a phone call from an “intake specialist” from the BBB. He had reviewed my forms and explained to me that the Better Business Bureau is a consumer advocacy group, blah blah blah. In a nutshell, if I get any complaints then I will be forced into answering the complaints and that a counselor would be assigned to any disputes and that the counselor would try and find a resolution for both parties. Immediately I am thing to myself, what if my trading system turns to shit and bunch of people start losing money? I am going to have to deal with some counselor that is going to want me to refund money? This is a risky bet for any trading vendor. And to make matters worse, the Better Business Bureau wanted to charge me $800 dollars as intake fee, and $500 each year, just to put that sticker on my site.

As I thought about this whole BBB accreditation, I could not help but think that the guy selling this trading system is really making an honest attempt at being honest. You can review the Better Business Bureau file here. There are 9 positive reviews, and one resolved complaint. I would consider these reviews to be very accurate. The Better Business Bureau is an entirely different animal than the fake review bullshit that can be found at Investimonials or random social media. A lot of you reading maybe thinking, “hey Emmett, quit blathering on about the BBB”. But you know what? Its kind of a big deal folks. The guy running this AlgorithmicTrading.Net company actually paid money and went through the intake process at the BBB, and if his system turns to crap and a bunch of folks start losing money, then you know for a fact that the BBB is going to come back and haunt him.

Blaring Weird Sighting Number Two

With all trading system vendors, they all love to display back tested results. If you know anything about back tested results for trading systems, then you already know that back tested results are as useless as second hand toilet paper. In fact, every time I view a page on a vendor that shows back tested results for a trading system, the contents within my stomach begin to curdle. They are vomit inducing. If they are not to you, then you have not spent enough time reviewing trading products. Back tested trading results mean nothing, the only thing that matters is actual results. The kind of results that can be shown and listed on a brokerage statement. Actual statements are the meat and potatoes that we want. Back tested results are puffery. Sure, they give us an idea of what to expect going forward, however all vendors pluck out the smoothest and prettiest of the results. In other words, the bride you are marrying is not the same bride that shows up later to consummate the marriage.

So lets jump to Blaring Weird Sighting Number Two…brokerage statements. You can clearly see on these pages that we are looking at brokerage statements from Trade Station. Admittedly, the entire year of 2014, for both clients that submitted brokerage statements is highly, highly impressive. Of course, both clients did add units aggressively throughout the year, but we cannot argue with these results. I would love to have these types of returns.

But are these brokerage account statements real? Or are they doctored nonsense, a creation of a clever graphic artist? And so I downloaded all of the statements for both clients, covering the entire year. Next I emailed the attached .pdf’s to broker support at Trade Station Securities. I specifically wanted to speak with a broker that could review these statements for authenticity. After 20 minutes of speaking on the phone, and another 6 hours of waiting for an answer, I got what I was looking for…the statements were in fact authentic.

Blaring Weird Sighting Number Three

Next, after confirming with the BBB and the authenticity of the brokerage statements, I then went “web scraping”. This is where I do an exhaustive google search of the company name, the principles, and look for any dirt floating or red flags floating around the internet. Surely there must be some dirt! This Rich Metzger is too squeaky clean. Finally I find some dirt. The Rip Off Report. Now I had this Rich Metzger exactly where I wanted him. The Rip Off Report! Nobody can survive a a bad write up on the Rip Off Report. And what I found out next is going to amaze you…

It turns out that the Rip Off Report actually gave Rich Metzger and My Trading Biz a reward. And certified him and his company as a “Rip Off Report Safe Business Service“. WTF! The Rip Off  Report actually likes this guy? Amazing. The Rip Off Report does not like anyone, anything, or any business. Its the cesspool of complaints. Once you get your own page on the Rip Off Report, you might as well change your name and move to Ecuador because your reputation as a business owner and a human being are now destroyed. No kidding folks. This is the oddest situation. Read the report

Report actually likes this guy? Amazing. The Rip Off Report does not like anyone, anything, or any business. Its the cesspool of complaints. Once you get your own page on the Rip Off Report, you might as well change your name and move to Ecuador because your reputation as a business owner and a human being are now destroyed. No kidding folks. This is the oddest situation. Read the report  yourself. To make all of this stranger than fiction, The Rip Off Report even had a third party, on-site verfier visit Rich Metzger and take pictures of him.

yourself. To make all of this stranger than fiction, The Rip Off Report even had a third party, on-site verfier visit Rich Metzger and take pictures of him.

The following is an excerpt from the Rip Off Report,

Ripoff Report’s discussions with MyStockTradingBiz have uncovered an ongoing commitment by the company to total client satisfaction. This commitment is unprecedented in the industry they serve. For one, they offer an onsite installation service where they actually travel to their customers location and perform a professional installation of the algorithms onto their customers tradestation platform. Furthermore, they provide 24/7 phone support to all customers. They are available to help ensure customers are properly trading their three algorithms. They don’t just do the install and vanish.

This is pretty impressive stuff folks. It seems like at every turn, I kept uncovering more information that kept reaffirming the honesty and legitimacy of this company.

AlgorithmicTrading.Net: The updated results for 2015

On both of the webpages, algorithimictrading.net and mystocktradingbiz.com, the performance figures for real time trading are all verified and real. But notice how there is no updated performance information for 2015? This made me suspicious and so I called and spoke with Mike Webber on the telephone. He directed me to the spreadsheet that contained the updated performance. Please view below:

[table id=10 /]

As you can see, they are in a little bit of a drawdown for 2015. Which for systematic trading, is not out of the ordinary and nothing to be concerned about. Mike explained that the draw down on the model account of $17,000 was actually close to 15%. Which again, is not a big deal. However, how do I know that Mike was not lying to me? And so I asked him. Mike then explained that as of the first of the year, the company decided to use a full service broker to execute the trades for customers. This would actually save the customer money by not having to open an account with Trade Station and avoid paying the platform fee’s. By using a full service broker, then the trades would be auto executed by someone that could “babysit” the platform each day, and make sure the trades were executed for each client properly. One of the unforeseen side effects of using the full service broker model was that the broker was actually getting better fills than the Trade Station broker.

Verifying The 2015 Results, Broker Relationship

What Mike was telling me over the phone sounded fine and good, but I wanted to speak with the actual broker assigned to execute these trades. And most importantly, I wanted to verify the authenticity of the 2015 spreadsheet. Next I called Barb Levy of The Fox Group, I wanted to know if this spreadsheet was extremely similar to what she was executing for clients. Barb Levy confirmed that she was in fact executing trades for customers of AlgortihmicTrading.Net. Barb went on to explain that she was not comfortable giving specific execution details, specific returns on accounts, and that doing so was against company policy. In speaking with Barb, I could tell that she was comfortable talking about the company, but giving specific account returns would be “crossing the line”. This was good enough for me. Brokers are notoriously tight lipped and sensitive about endorsement.

One other thing I would like to mention is that Rich Metzger negotiated a rate of $6.50 round turn for each of his referred clients. This is actually a great deal. Someone else has to babysit the trades at a very reasonable price.

Everything Looks Good, But Who Is Rich Metzger, The Phone Call

Ok, so after a long two weeks of researching, digging up information, looking for dirt, etc. I have been able to conclude that this company is real. The average return for 2014 was 99%, the average return for 2015 is currently -15%, and everything checks out thus far. But one thing I really wanted to know about is the developer. I wanted to speak with Rich Metzger on the telephone, ask him some tough questions and find out more about him. What I discovered is that this guy is the real deal. He is an electrical engineer with an emphasis on computer science. Basically his entire career has been about designing algorithms for industrial purposes. Our conversation lasted for quite some time and I was extremely impressed. I also asked him to email a quick summary of who is he is why he started this company. I got the following response from Rich,

Graduated with a Bachelor of Science in Electrical Engineering back in 2001 ( computer science emphasis). I’ve worked for Fortune 500 companies as a logic design engineer including Hewlett-Packard, Intel and Qualcomm until 2013 when I decided to start my own Algorithm Development Company. My expertise in algorithm development, finite state machine coding/design and advanced mathematics has made me the perfect fit for quant/mechanical trading.

As far as trading goes, I traded on the side the entire time while doing the corporate grind, mostly losing money as my emotions whipped me in and out of trades at pretty much the exact wrong time. It wasn’t until I began doing research on quant trading that I began to realize there is a better way. I signed up with tradestation and began coding very basic algorithms and quickly started to realize the power of back-testing. The bad news was that also started the “learning phase again” quickly realizing that back-testing is only a small part of the battle. I coded over well over 300 algorithms, almost all of which did poorly when applied to live trades. A few stood out as gems and those are what we offer to our customers today. The white paper describes our design methodology which includes trading in liquid markets, back-testing, independent evaluations, large average gain per trade, etc.

My best advice to future developers? Keep your algorithm as simple as possible. The fewer the technical indicators the better (1-2 is ideal). Be honest with yourself and try to prove your algorithm wrong. Don’t get caught up in the emotions of thinking you found the holy grail, you really didn’t because it doesn’t exist. Try to find reasons why your algorithm will fail once going live and then let the chips fall where they may!

Thanks,

Richard

OK Richard, That Sounds Nice But This Annoyed Me…

One of the things that annoyed me was the presence of two web sites. MyStockTradingBiz.com contains roughly the exact same information as AlgorithmicTrading.com. And in all honesty, neither site does a very compelling job of selling the service. However, I was able to pull out a very well drafted .pdf “White Paper” which is exactly the information that you need that explains everything in great detail. I mentioned the confusion and incongruencies of both websites to Rich. He completely agreed. The original name was MyStockTradingBiz.com, which to me sounds scammy. Rich agreed and began building out AlgorithmicTrading.net, and will be shutting down the MyStockTradingBiz.com website in the near future. However, even the AlgorithimicTrading.com website is probably too rich and cumbersome for most folks. The .pdf white paper is really the meat and potatoes of the program. Its does an excellent job at describing exactly what the Algorithmic Trading company can do for you.

QA-Products-Offered-and-Design-Methodologies-5-AlgosWrapping Things Up

This is probably one of the most exhaustive and well researched blog posts that I have made. Considering that this is a trading system, I wanted to really make sure that every detail was fully researched, and every piece of evidence was documented and investigated. For me, I really like this trading system and am personally very close to making a decision on purchasing the system and then opening an account at Fox Trading. A lot of mental horsepower went into the creation of the algos. And I have a double extra does of confidence in knowing that everyone involved at this company also has their money trading the system. Just too many positive variables to ignore this company.

Once again, thanks for reading and don’t forget to leave any comments or questions below.

Before investing in AlgorithmicTradingLLC I tried to do a lot of research, digging, and finding reviews etcetera. Most of them were pretty positive and people spoke highly of the owner, Richard. However, there were a few reviews warning that they had lost a lot of money in that it was just a scam. Unfortunately, I did not heed those reviews. After losing 40% in 2024 I have finally stopped trading the smart pivot algorithm.

Around June I started calling and emailing about once a month because the account was having 5% plus losses per month. The first few months the owner said the algo was within back testing limits, then for a few months he said he was making small tweaks, and he was confident it would turn around. Somewhere around September I called the 800 number on the website which was disconnected. He gave me a new 800 number which a month later was disconnected. He did reply to my most recent December email and in earnest was empathic to the performance.

I switched from his Geronimo algo in 2023 when it was underperforming and started the new smart pivot which was going to be better. And now his partner has a new algo called alpha which is going to be better.

This seems to be a reoccurring theme and I’m guessing that perhaps the algorithms work for a short time and then fail so he starts up a new one so he can sell more licenses. This pretty much seems like a scam to me, like his swindling people out of their money with false pretenses of his abilities. The owner comes across as a genuinely good person trying to make the best algo’s to help clients make money, and he absolutely denies there is a different plan.

Either he is not good at writing these algos and is selling licenses to a product that is not going to work, or worse, he wrote the algo and is aware of how the algo is trading and is trading in the opposite direction taking the money from the people that he sold licenses to, which again he unequivocally denies.

There are other companies out there with better algorithms, although I have not found one that performs really well during these up markets.

Hasn’t responded to my emails and has not sent any updates in over a year.

I now understand that the information and statements on AlgorithmicTrading.net do not reflect actual real account performance.

My $100,000 original investment in July 2018 is now only worth $68,893.

Not to mention the $17,000 license fee I paid ( to trade up to 32 units). And the $9,324 maintenance fees I paid for the few profitable periods early on.

I was a loyal and dutiful client for this nearly five year period. I did not take one dime out of the account.

This review was done in 2015, and now we are in 2022.

Can someone please share any current experience with this Company? Are the reliable? Are you able to get any solid returns?

Why is nearly a carbon copy review by the same author of this company on tradingschools.pro given a 1.1 star rating in 2019, yet here, the 2015 review it’s 4.7 stars? Shouldn’t one of these be updated…which rating reflects the current status of this product?

Algorithmic Trading Review – TradingSchools.Pro

The .pro website is a copycat website. Actually, there are a few of these people taking my content and rewriting it, or just copying it outright (illegally) with the intent of stealing traffic or changing a narrative.

For example, you said that I gave Algo Trading a great review, which I did. Yet, the .pro website gave it a negative review. Why? The answer is because whoever is running the .pro website is probably also selling a product or service that competes with Algo Trading, and somewhere on the .pro website you will probably find a mechanism to push traffic to their product.

What is my stance on these copycat websites? I guess I could take it as a compliment as “imitation is the sincerest form of flattery.” And, I could be very upset they are stealing potential advertising revenue from TradingSchools.Org. But TradingSchools.Org was never meant to be a commercial venture, it’s just a mechanism for me to express my outrage at the bullshit of some of the “trading educators.”

Further, the crumbs of income that TradingSchools.Org earns through affiliate income or advertising does not even pay the legal fees of running a hyperbolic website, like TradingSchools.Org.

Hopefully, this helps you understand the dynamics at play. Everyone is fighting for traffic and reputation and earning income. And then you have me…the asshole that care not about any of these fuckers.

“And then you have me…the asshole that care not about any of these fuckers.”

Straight up respect Emmet. Seriously, you da Man!

I recall those copycat sites were mainly just rage by these reviewed and exposed scammers attempting to initially divert newbs and confuse them away from the exposing purpose of tradingschools. But tradingschools steadily built a rep and produced results that helped get real action by the regulators finally on these shamshows. i.e. “tradingschools does it’s job , and it does it well.” re: SchoolofTrade, the lady who hired stalkers on Emmett, OTA, RagingBull, and Barak, among probably several others. It’s not always clean, sometimes with unintended results (the crappy sec statement on cfds), but at least some things were done, when there was nothing except bought out review sites before.

As for the crumbs of revenue from tradingschools, likely it’s only enough to live in a hut abode , but at least I recall Emmett has become quite the whistleblower for the feds on retail trading scams, with payout I assume used in mission faith defending against these six figure costing lawsuits from the worst big scams reviewed such as WT and RB. Certainly a lot more helpful to the retailers than Belfort ever was in his reform phase.

[]

Thanks for the in depth review!

Hello I am curious if you did end up purchasing a license for the software and if you did what was your experience? Thanks!

Hi Emmett,

As a first time reader of your website, I have doubts if your reviews are researched in detail. Your mission should be to safe guard the hard earn money and time of your readers. I have more faith coming from the negative comments of this company than your review. The company, Algorithmic Trading, is just making it too hard to find truthful information about their company. We all know in the equities education and vending industry that all claims are considered false unless it can be verified.

Who is going to waste their time selling you a “map” to their gold mine for $100 a pop.

Bob

“As a first time reader of your website, I have doubts if your reviews are researched in detail.”

first time reader, Plleaase. Nothing could be further from the truth.

Hi all who have been trading this system. Please email me at koolb@hotmail.com. I am seriously considering this system. Specifically the ProTrader (6 algos).

Forgive the weird name, my real name is John and I am looking to create a WhatsApp group for real traders of these algos.

Hi, any customers out there that made it big and then successfully cashed out?

Hi Mike F, can you give updates to your trades 2019? Just doing some research at the moment about this company and their products, so it would be nice to hear results from person like you who’s been using their system/product for quite sometime now.

thanks in advance

Just wanted to provide a real world review from an actual customer. I researched the system for about 2 months before pulling the trigger on a 60k account. I went live Dec 1st and as of today, my net Liq is 82,115. A 37% Gain in less than 2 months. Early December started out a bit slow but it was off to the races shortly afterwards. I trade 50% crusher and 50% swing. I plan to upgrade my plan and I’d be interested in connecting with other current members. Everyone has been great, Rich, Richard, Barb, and Fox Group. My only request would be more communication on the various Algos performance at the close of every month. Emmett, thanks for the review.

Mike F. – was looking into this solution…wondering how your performance has been since you posted this given the correction we’ve experienced earlier this year(2018). I’m also concerned as their website hasn’t posted any 2018 results for the S&P Crusher product…. Thank you!

Mike F i`m also a Live customer, recently started around a month, right now i`m a bit down, lets connect in real time or on whatsapp it would be nice to work with some one doing this live, you can email me at shay@openwebdesign.org feel free to email me.

I just heard about these guys. Apparently the 2 systems they now promote (SwingTrader and S&P Crusher 2) have done really well for the last few years. Of course we’ve mostly had a non-stop bull market with little volatility and low drawdowns (especially this year). Given some of their past performance (based on this blog) and the price (did I read $15K?), I’m not very interested. I’d be more willing to try them if they had a reasonable monthly fee instead.

Can anyone verify their recent performance (2016-present)?

Emmet, where can i email you please?

Guys, is there any further update?I want to see live results for 2015, 2016 and 2017, on all my research this company looks much better then the others but an updated review would be awesome, also did emminent eventually get this sytem and start trading with it?

Thanks

Lots of discussion here, from both sides. I am simply going to state that the drawdowns and sharpe ratios are totally unacceptable from an investing standpoint. Everything depends on entry timing. Get lucky and you can stay well above break even; get unlucky and you can loose so much as to never be able to recover unless more funds are added. Plenty of disclaimers on the web site, owner/programmer is trying to be legit, and all that, but my best advice is “stay the hell away”.

I did not see a date but the creator of this system, Richard Metzger, has it up for sale. https://www.bizbuysell.com/Business-Opportunity/Stock-Market-Trading-FinTech-Software/1340829/

I’m not sure what exactly is being offered for sale. I think the owner is offering licenses (starting at $16,000) to use his proprietary software. With a license, a person could start a home-based business trading the financial assets that his software analyzes. This business listing would seem to be no more than an advertisement to attract new customers by framing the purchase of a license as the purchase of a business. Note that the EBITDA is exactly $16,000 less than the gross revenue – the difference presumably being the cost of the minimum fee for a license. To what extent the listed gross revenue is real (based on actual trading results) or hypothetical is not clear.

Check out Collective2. Very similar to Richard’s systems, and you can mesh and put together strategies. you can also have full transparency of history. To pay $15,000 for similar strategies–seems like Richard’s system is kind of scamming you. People, there are other auto-trading systems out there–and you have access and control the system. Richard should actually look and promote his systems on Collective2. Of course, he would have to be more transparent and prove his system–instead of hiding behind constant changing marketing and data/performance augmentation: for the capital, you can easily find other systems on Collective2.com that outperform Richard’s systems. Again, not saying Richard’s systems are junk: just that they are NOT, NOT worth the $15,000 price tag–outrageous. I would actually consider using his NQ algo if I could combine it with some of my other strategies now on Collective2.

I believe Richard really wants his system profitable. However, for the past one to two years, his system made his clients lost a lot of money, let alone the $15k membership fee. His system generally makes money for 3 months, then losts all of the profit in the 4th month, or even worse. My friend lost about $15k within the first two months (1/3 of the capital), then earned some money back, then lost money again. Finally, he still lost $15k after half a year. Richard is still improving his system, but I really think he should charge his clients monthly, not $15k at the beginning. It’s unfair and not right that He made his clients lost $20k-30k (including membership Fee) within several months……

Thought-provoking comments . I am thankful for the insight , Does anyone know if my company would be able to obtain a template IRS 13614-C document to use ?

Again–Richard & Emmet? why not respond to the fact that Richard has recommended and stated to former customers that the NQ trading system he promoted and sold for years is not likely to really be beneficial? Why Richard, did you email clients to really consider and basically recommend to stop the NQ strategy. Why??

I am former legacy customer that has decided to move on. I did very good in the early days–when there were huge gap ups overnight and that is essentially how it made it so much $$. Market was just going straight up and this system did well. However, during trending markets it has the potential to rip your head off. The system has changed a lot. His performance stats and advertising changes too frequently. However, lately, nothing from good old Richard. Poor follow-up from Richard. In the early years he would often reach out and update routinely his customer base. He even would send out happy holiday greetings. Rarely ever hear anything from him or his company anymore. No updates, encouragement, of ‘coaching’ for the very high priced system he has sold.

Gain has a high reputation. I recently discontinued my trading–and a major red flag: there executive team contacted me personally and there was not one mention at all about why I was deciding to stop the system. I get the hint that dude, yes, take your $$ and get out now before this system destroys every last penny. They were making me know there were other strategies out there to trade.

Anyone interested in similar trading: I would highly recommend checking out Collective2. Excellent. Have to be very careful though and know what you are doing but there is incredible transparency and potential trading. By pulling my $$ out of Gain away from Richard, I have made the subscription fees all back in 2 weeks times utilizing several different strategies–with different developers. So, traders: check them out.

Also, a hint to Richard: you actually should really consider promoting your systems with Collective2. Your systems have potential. That seems more of an environment you could really prosper with. They are monthly fees: much more reasonable than your incredible fees for your subscriptions. There are actually many strategies similar to your design: so your $15,000 fees are really outrageous compared to what you can get with Collective2. It is auto traded and synced with interactive brokers. Also, subscriber can also increase or decrease/scale up or down trading size. No limits to how many contracts you can trade with–no limits. Really is crazy you limit trade size. Most subscriptions at Collective 2 range from $75 to 400 monthly-most in $200 range. Plus you can stop or pause any trading strategy.

I think this service should be reviewed again. looks very shady.

I like Richard. Nice guy. Very honest. Trading is hard! Every time he hits a draw down, the knives come out.

It is not the DD what the problem is but the price. The price simply takes away all the profits. Then how is a subscriber supposed to make money, specially if they charge more for using more cars? Or is that price for life, thus the first year’s return is for the payment, and it starts to generate money from year 2 only? That is an investment, not a subscription service…

Draw downs are tough enough when you are doing your own trading and know what you are doing, but taking draw downs on some algo you know nothing about. Man that is tough!! To me something like this is for people who have more money than they know what to do with, so if they lose no big deal. I doubt that describes most of his subscribers.

Even after they are told that Algo trading is no Holy Frail, and after they say that they agree, they are still looking for a system that has a straight up equity curve with no drawdowns. So when the drawdown starts, they think it is time to abandon the system and look for the next one, one that has no drawdowns.

In other words, they are still seeking that Holy Grail, even while they deny it. They only pay lip service to the notion that the system can sustain losses for a considerable length of time.

Why can’t people see reality? These algorithms trade in markets that are purely speculative! What kind of actual professional would do this? NONE! Sit back take a deep breath and realize these are PURE gambling programs… I stake my life on the fact that NOT ONE of Richards customers has a clue as to how financial markets work! They just have surplus cash and don’t know what to do with it…. Pure and simple. He is trying to “count cards”… As always, the house is onto the game…. As such, this will fail.

Why do you block my comments?

Just looked them up with their recent performance. They have 4 products, and I picked NQ Active Trader, because it has a 1 year Live performance displayed, showing return of 30%. (4.2K on a 15K account) That sounds good, but the advertised return based on back testing is 104%. That is quite a bit of a difference, and why would you use a backtesing result when you have actual Live trading performance??? Oh, because that shows 3 times more return, that is why.

I am not sure what their cost is, Emmett says they are expensive. This only works if one has a fairly large account (I would say 100K at least) to make it worth the risk…

After reading some of the posts here, Richard says about the price:

5K for 1 contract traded, 15K for 4 contracts. Well, if I only traded 1 contract, the price of the system killed all the profits for the last 12 months (NQ Active Trader) and I would end up with -$800 in the red. And trading 4 contracts on a 60K account after subtracting the cost of 15K gives a 16.8-15=1.8K profit or 3% instead of the advertised 104%.

What is a 100% difference between friends? Bottom line is, if a system is very expensive, you definitely have to calculate the cost of the system into the performance because that makes a HUGE difference….

My take on this system, it might work, but the cost of it makes it prohibitively expensive and not worth it…

What is “100% difference”, you ask? In my book it’s called “fraud”.

It was a joke, but the difference was between backtested results and real results minus subscription fee.

To me, the only purpose of a backtest, is to find out if a strategy would have made money, if we had perfect knowledge of the future. Backtest is the only situation in which we always know what happened after the trade entry. If the backtest cannot make a profit, then for me, there is then no point in testing forward on live data. IOW, I use backtesting to eliminate those strategies that sounded like a good idea when I first formulated them, but that prove to be a dud, even when I am essentially curve-fitting.

In my experience, most strategies fail in backtest, so I get to cut my wasted time really short, and can devote my time to forward testing only those strategies which have shown that they could probably make a profit. I only backtest on bars which show the real price action, mostly Range bars.

For the life of me I cannot imagine trading another person’s algorithm. First I would wonder why he is not selling it to a hedge fund for a billion dollars being they can not make a 30% return. But more important what happens during draw downs and you are down 30%. Are you going to continue taking trades based on an algorithm you know nothing about?

I guess it is a personality thing, but I would never be interested in this. To each there own.

Come on, be realistic. Hedge Funds have a remarkable arrogance about all the Math and CS Ph. D’s that they have in their quant department. Someone with only a BS cannot even get in the door to speak to a janitor, let alone the person who negotiates with vendors of any kind.

Now, on the other hand, if one of their broker contacts were to tell them about some autotrader that is killing it …. Of course, being the cynic that I am I am inclined to believe that in that case they would rather bribe the broker for the code and reverse engineer it. Only if that failed, might the call the developer, and try to swindle him out of the original code.

If you can show investors you can make 30% return year after year they will be knocking down your door. Bernie Madoff only showed 10% or so. Heck you can even start your own mutual fund or hedge fund and get tracked. Yes you have to do some work to do that. You could even start a newsletter and be tracked by Hulbert. All these mutual funds, hedge funds and CTAs performance are publicly available. Have you seen their returns? They are horrible.

I know people think that day trading is some miracle where you will make incredible returns, but in the current market if you can make 30%, you will have no problems finding investors to back you. Heck I even bet MES would offer you some deal and give you a million dollars to invest.

I even tell you a true story. In addition to be a stock investor I am a real estate investor. My daughter comes to me and says she wants to buy an investment property but not sure she can get a bank loan. And I told her she does not need a bank loan, if you can show the deal clearly laid out on paper, investors will give you the money including me. But she needed to show the purchase price all the cost of repairs and comps after fixed up. I wanted to see all the details.

There are investors that will back you if you can show the deal or in stocks can show a 30% consistent return. Anyway that is my 2 cents worth.

I will add one more thing. Many of these con artist trading room have started private hedge funds and guess what when they had to actually place real trades they just lost money. For a classic one look at good old Larry Williams.

Well, speculating in commodities is tough. Even the real ones blew some up. After he ended the spectacularly successful Turtle Traders experiment, even Richard Dennis blew up one of his funds.

And yes, at this time, it is almost certain that Larry Williams got lucky in winning his championship, as he seems to have never been able to come close to even 20% of those returns any time later.

Then luck must be running in the Williams family because his daughter also won the trading championship…

Yes, I know that she did. And has she been able to duplicate that performance or even a fraction of it since? Just like her father, no.

Of course, maybe they are the most skilled traders on earth, who just happen to be in a more than a decade long drawdown?

I understand and agree with all your points in this comment, but maybe I was unclear in my comment. I was really only commenting about your comment: “First I would wonder why he is not selling it to a hedge fund …” and how it is not that easy to get in to meet the decision maker at a hedge fund. I was not really commenting at all about the returns of his Algo.

All the things that you have stated are ways that would get the attention of some hedge fund. The method that he is using, essentially backdooring into a broker who might pass on the word, might also do the same. That, of course, is only if the returns are as spectacular as you are saying.

Osikani you clearly understand the real world of investing unlike so many others. For the record I was only using the returns stated by the poster who this sub thread was in response to. I seriously doubt he is doing 30% returns. I would love to see Emmett post continued updated returns via real broker statements or using the robot so we could see his real returns.

Important Update.

Richard-developer recently emailed all former and current users of his NQ/ES packages sold, and basically recommended switching to his new algo’s–stating the S&P Crusher package would like do better. Emmett, I wonder what you think of this. This might be a major red flag. I think Richard is actually meaning well: actually offering former customers to switch to the new alga’s with no charge. But, why? Of course, Richard provides detailed information that he is not a financial advisor and cannot recommend specific advise: but, reading between the lines: it was suggested that customers strongly consider his new algo’s.

1. Why is the NQ license no longer offered? I recall in the beginning under his FAQ that there would not really be any issues offering the NQ package to many customers: meaning, is it possible too many customers could trade this and effect the results. The response then was nearly impossible considering the volume of NQ futures contracts traded. So, why is the NQ license no longer offered?? And, now curiously, seems a brand new algo is now being recommended.

2. I thought the NQ was something for the long-term–could survive up, down, and trending markets. I understand the issues of draw-downs. However, in his recent videos and blogs, he specifically goes through draw-downs and talks about that they will happen and be prepared, but stick it out. The algo almost always recovers well months later (look at the website). Now, an email basically stating to highly take his recommendation to switch completely to the new algo’s. What? makes no sense when you look at the data on his website–especially the draw down analysis. Completely contraindicates the whole point of algo trading and what he has educated his clients over the past few months (nerves of steel??). Algo is trading without emotions. Look back through his prior videos–stay the course. In fact, in 1 video he discusses that after bigger downs (which are to be expected), that is the point you might consider adding more equity/and increasing contract size–as typically, the months following the market corrects and outsized returns can be completed. Now, he seems to be encouraging customers to stop the NQ algo and jump over the somehow newly developed algo–‘it is likely to outperform’. Just how? Do we know that somehow the market is going to continue trading side-ways. Do we really know if the market will suddenly drop tomorrow, or sky-rocket 5-10% in the next 1 month. Again-seems contrary to algo trading. So, what–when shall we jump back into the NQ algo–likely before we figure this out the NQ algo just takes off and outperforms. I thought the NQ algo is something you just keep trading, you don’t jump in and out of it: I am so confused.

3. There have been a lot of changes–additions to the algo which is fine: but, now: Richard is suggesting to actually stop using the NQ (of course, it is really up to your discretion).

4. If the NQ is so good–why would you honestly need to switch or add-on another algo. Why is the NQ not being suggested as ‘the best’ algo anymore. All of sudden a brand new algo has been developed. I am all about adding diverse algo’s, and different nuances and combining algos could be beneficial and help smooth out drawn downs: but to stop an algo during a draw down seems careless and reckless. Again, how do you not know the next 2 months you get the biggest net monthly returns? Makes no sense with any of his prior explanations on dealing with draw downs and managing them appropriately. Has he lost confidence in the algo??

5. Why would Richard offer clients that were trading the NQ package prior switch to the new algo without fee: makes no sense. Seems he feels bad or knows that the NQ is not performing as advertised: especially for the high $15,000 price tag so many of us payed. really: stop this this amazing algo that you payed for: and try this one instead: it may, or may not outperform. But, I cannot really help with decisions, you have to decide. Or, try trading both–if you want. But, we think the new algo will do better–and for how long?

6. What exactly Richard are you doing: what have you been trading?? You state you trade the algo’s, why and when did you stop the NQ package.

Emmett,

You don’t have a large enough sample size from various customers to be giving these guys all these high marks..(Stars)… I beg you to reconsider your endorsement here. You are going to cause more damage than good! I talked to these guys on the phone and a guy named “Rich” the salesman claimed to have been trading his own money with this guy. If this were true and IF he was having stellar results why would salesman “Rich” not post all of his own statements from day one???!?! This would be a salesman’s best advertising! I also noticed that “Rich” seemed very young and did not know a single thing about financial markets. Down the road the LLC will be defunct and there will be nothing left for the buzzards to eat… This company is TERRIBLE!! They are misrepresenting their product! THIS IS A STARTUP COMPANY AND PEOPLE ARE NOT GETTING ANY SHARES FOR THEIR INVESTMENT FEE… Come on people! If it does not sound right up front, then is it? I could say more, but why bother when so many people refuse to take off their “rose colored glasses”…

I too fall into the category that believes “bots are BS.” But Richard, you have a very easy way to make Mike and Rob B eat crow. Open a $15,000 live account, trade it with your bot and post the brokerage statements. Let’s say 6 months of brokerage statements to prove the worth of the algo. If you don’t take up Rob B’s challenge then you can’t expect anyone here to believe your claims.

WOW! Well said on those posts. Lets get real and forget the “simulated account” nonsense… Open a new account and post the results AND lets factor in all costs for trading, buying algo’s, annual fee’s AND TAXES if there are any real profits… When all is said and done, I suspect these algo’s will be toast. Likely that it would be better to have your money in brown paper sack.

Tough crowd! Man, I have been writing these reviews for over a year. Its so darn difficult to find trading vendors with products that make money.

The problem is I have yet to find a retailer that takes sim money. Until that happens real trading with real slippage and commission cost is needed to evaluate performance. I do not require tax rates to be shown, as no profit no taxes (I must be getting soft in my old age LOL).

I can do even better, in fact we have done better.

They are located here for anyone to see:

http://algorithmictrading.net/active-trader-nq-package/

(once you are at this page, scroll down to see them)

This account started with about 16K and as of 20 Feb 2016, it has made $7,461 (about 49%). The website isn’t updated with feb results yet, since the month is not over. This account statement is exactly what you are asking for. It ONLY trades the NQ Active (v2) and has traded 1 contract the entire time, on all five algos. It’s our “base” account we use to track live performance on the NQ Active. ** Past results not indicative of future results & trading futures involves substantial risk of loss

In addition, i have statements from a mix account that go back 14 months (jan 2015-now). We rolled out the v2 algos in march 2015, so they are a mix of the two packages. I’m happy to provide that to anyone who wants to see them as well, but they are from a tradestation account not the auto-execution broker account. They will show gains, but the contract sizes changed throughout that period as funds were added, so it’s not considered typical and therefore we don’t post it anymore at our attorneys recommendation.

In addition, I have statements from our NQ Legacy package that were traded from Aug 2013-Nov 2014. We include our back-tested losses from dec 2014 when we share that. This is from our original algos (O1,B1,T1) trading the aggressive allocation. These statements will blow anyone away as they show +100% gains (including an estimate of losses from the Dec 2014 drawdown). Also removed from the website a few months ago at our attorneys recommendation (because we don’t sell that package anymore). ** Past results not indicative of future results & trading futures involves substantial risk of loss

In addition, I have statements from other NQ Active Trader (v2) accounts that I’m happy to share (some mixed/some pretty static). They also will show gains, but again – funds were added, funds taken out, contract sizes changed, etc – so they are not as typical and were removed at my attorneys recommendation.

In addition, I have statements from an R&D account that is trading an algorithm package we will be rolling out at some point (once it’s traded live longer), so far it is doing amazing but we are still vetting it.

In addition, I have statements from another R&D account that is trading our ES Weekly Options algo that we are rolling out soon. It’s only traded live one month but has had four winning trades so far and is up about 10%.

We really have a lot of LIVE data we can share beyond what we post on the website, both from our accounts and from customers. There is no shortage, just email us and we can assist provide them. If i could upload them all onto this blog, i would. Just remember, since they are live accounts, they are not as “clean”. Funds are added, taken out, number of contracts traded change mid-month, etc. By law, we are required to show accounts that are “typical” of our customers, so we only show the base client account now, the one referenced above.

We emphasize the back-tested results on the website, because we want to show the “normalized results” and it is in our customers best interest to also see the back-tested, however we have plenty of live data we can share as well and more importantly, we do share it online.

Perhaps the most skeptic person on here can email me and he can share his findings?

I’m ok with that – but please remember, we are not registered CTA’s. The results are not audited by any government agencies. However, they are real results from our algorithms and don’t contain discretionary trades as far as I know. I think this person will be pretty amazed. We don’t control accounts, but are allowed to share live results with customers because it is in their best interest to see all the data we have, not just the backtested.

I’m really not trying to convince anyone to buy the algos, but I do want to give answers and provide the data we have. So, just ask! Email me richard@algorithmictrading.net.

Our live results have been impressive but this is no guarantee they will continue. If it was, trading would be easy and we all know it’s not.

So you pick, who wants to email me to review live trades?

No need to review live trades… Several things are at issue here. Theoretical accounts don’t matter except for testing. We need actual ongoing customer accounts which take ALL FEE’s and costs into play. There are two fatal flaws in this system. These two flaws will show up over the long term and will not manifest overnight. In addition, the language use of the word “drawdown” is totally amateurish… Call it what it really is, its a LOSS period. I have no doubt the the developers and team are earnest, and trying to be honest about the system. This does NOT prevent them from become victims of a self fulfilling prophecy. The two fatal flaws I mentioned earlier are apparent to the experienced market, and had they not been there, Goldman Sachs, JP Morgan, and a cadre of large hedge funds and pension funds would have already made these guys an offer they could not refuse. I applaud the efforts here, but I suspect Richard is as surprised as anyone that people actually give him money for this project of his. This in fact reinforces the “self fulfilling prophecy” issues, and creates greater risks. For the accounts to have ever suffered the losses that some of the users have posted shows a third fatal flaw in the risk management criteria for these leveraged instruments. The markets are complex and too much for one programmer to handle over the long term. Especially one who has not had a proper financial market education. By this, I do not mean a “business” degree from somewhere. This type of training only comes from hedge finds, investment banks, and large pension funds… It is NOT available elsewhere. OK? Caveat Emptor.

I guess I fall into that skeptical category. In fairness to you, I am skeptical of all bots not just yours, I would not use one and I will state why. First most bots being sold only show back tested results. That is a complete joke. As someone that did data analysis for years (I too have a BSEE degree) I can data mine any data and make a nice curve fit past data, but predicting the future is another story. And when I go to your site where the performance results are shown it states the following:

“The table below shows simulated/back-tested account assuming a $15,000 starting account trading one contract each on five total algorithms”

I am not interested in some simulated/back-tested results. That has zero value to me.

You mentioned results from someone else account. Here would be my challenge to you and maybe you are already doing it. If you believe in the algo then open a live account that trades it, post the broker’s statement once a month and then show a real live equity curve with slippage and all.

The other thing that really concerns me about a bot is as you stated we all have draw downs. In fact a wise person once said, “your worst draw down is in front of you”, and that statement is very very true. I know people have the fantasy view they will start to trade with their bot and the equity curve will just shoot straight up but more than likely right after you start trading with your bot you will immediately go into draw downs. Now I have spent 10 thousands of hours looking at charts and I fully understand about draw downs and what to expect based on my long history of trading. But I just wonder if right after someone uses a bot they really know nothing about, after all they did not design it, and it goes into draw down how long will they give it. I say it is easy to use a bot to trade other people’s money not so easy to trade your own life savings.

I have met so many people looking for that Holy Grail bot to trade for them as they are too lazy or do not have the time to trade and I have yet to meet one that has made any money. Maybe your bot is the real deal, but I would be much more impressed to see a real account being traded and those results posted on a daily basis showing actual broker’s statements. And no mods to the bot can be done unless notice is given and the old bots performance must still be shown. Otherwise once the bot starts to lose you will dump those results and just start with a new bot.

Bottom line unless you wrote the bot and know it inside and out, I am not a bot fan for trading your own money. But I would encourage anyone actually trading this bot to post their experience.

OK just had to look a little closer after reading this… Richard Metzger is an EE???

My brother is an EE also. Richard Metzger is shown as age 31? 2016-31 means born in 1985. This means he graduated university at age 16 with a BS in EE. Must have started at age 12 or so… Worked for all those companies too… Well whatever… Lets all give him a high fiver… And for those of you who have paid him and about to pay him. We Italians have a name for you…

It’s been quite a while since I visited the messages and just wanted to provide a few comments.

My Age: No I am not 31. I’m not sure where that’s posted but it’s wrong. I’m actually in my early forties. Yes, I do have a B.S.E.E and worked at the companies quoted. After graduating high-school in 1992, I served honorably in the military for four years (Infantry- Airborne), went to college on the GI Bill, graduated with a B.S.E.E, worked in corporate America for 10 years as a logic design engineer, then started my own algorithm development company. I have no problem providing my resume/degree to Emmett if he’d like to see it.

Complaints: Yes, not all of our customers are happy. However, we did a recent analysis and found that the complaint rate is only about 5% (determined by analyzing the number of customers we have vs. the number of unique complaints seen online; it appears that the vast majority of the 5% were early NQ Legacy customers who traded on Tradestation based on their comments).

Priceless Algorithm: No, this is not the holy grail. The NQ Active Trader package is an extremely high quality suite of algorithms (our opinion), but certainly not the holy grail. We take losses and trading the algorithms is not easy (I really mean that). These algorithms are not cheap and are designed for someone that wants to trade the futures market aggressively and has risk capital. With the potential large gains, comes the potential for large drawdowns. You will never find a picture of me standing in front of a sports car saying that this is easy money and everyone is going to get rich. We are a third party trading system company that takes our job seriously. We do not guarantee gains or easy money. These algorithms are priced at a high point and are not for everyone. Regarding Ponzi-scheme, we never touch anyone’s money, we are paid a licensing fee for the algorithms use. We are not registered CTA’s and claim the self-executing exemption granted by the CFTC 14(a)(10) and 4(m)(1) of the act.

Performance of NQ Active Trader package (v2): This package was rolled out in March 2015 (almost 10 months ago). Data from the auto-execution broker shows 90% of our customers are trading this package. Prior to the NQ Active trader package, we traded the NQ Legacy package. The v2 rollout 10 months ago included adding the PushPull and the Short algo.

One of our “customer accounts”, who has traded the NQ Active Trader v2 package exclusively since June 2015, has done as follows (past performance not indicative of future performance & trading futures is not for everyone and involves substantial risk of loss):

June 2015: +$54

July 2015: +$1,223

Aug 2015: +$1,684

Sep 2015: +$2,179

Oct 2015: +$1,205

Nov 2015:-$569

Dec 2015: -$2,682

Jan 2016: +$2,233

Feb 2015: +$2,134 (as of 2/20/16).

Total Gain: $7,461 on a $15k account. Market is down -6.62% for the same period.

Not including June (he started late june and missed some of the losing trades), he is up 6 months and down 2 months. His statements are posted on our website here (scroll down to see Individual F): http://algorithmictrading.net/active-trader-nq-package/

Those results should be typical of what our NQ Active Trader customers saw (90% of current traders), assuming they traded 1 contract on each algo and never turned off any of the algos. Those that traded 2 contracts, should have seen 2X what individual F did, and those that traded three contracts, 3X that. Again, past performance is not indicative of future performance & trading futures involves substantial risk of loss. This does not include our licensing fee, which varies depending on number of contracts traded.

We do not “hard sell” these algorithms. We do present the data and we are very proud of our results. There is a legitimate need for quality trading algorithms for the retail day trader and we are doing our best to provide that.

I wish everyone success and would be happy to provide Emmett with documentation backing up the above comments.

We have found that our customers generally don’t post the positive, although some do. We appreciate those of you who do because we are doing our best to run an honorable company. I’m signing off now. Maybe I’ll check back in a couple months from now.

Wishing everyone the best!

Sometimes I get these reviews right. I got this guy right.

I agree with his comments about people not posting positive feedback, but liberally apply negative feedback. In my opinion, this has to do with expectations. People come into the program carrying their best hopes and expectations, so when the best happens, its just what they were expecting. But when they enter the game at the point of inevitable draw down, then it feels like the world is against them.

Have been writing these reviews for over a year now. How many people get a positive rating? Hardly anyone. And no, I have not been a paid a nickel.

Thanks Emmett. To your point, you will notice that the negative comments always come up when we have a losing month. Notice, from July 2015 – Nov 2015, not a lot of negative comments. December 2015 we have a losing month and there it is, a couple trickle in (as if it’s a big surprise that we have losing months). Jan-Feb 2016 we’re up and you don’t see the negatives since we are up i guess. You are right, that expectations are probably too high for some people. Everyone wants to believe that the holy grail exists, sadly it doesn’t and there is absolutely no such thing as an “easy” trading system. Even when we’re up (as we are now), it always feels like you left some on the table.

If someone looks closely at the negative comments, they will also notice that many of them are not customers, just skeptical observers. I understand that, I guess I would be skeptical too.

LOL at your 5% complaint rate, most people have lost with your shitty algos and moved on. Not everyone goes on a online review site to vent. Anyone who bought your shitty algos in the last 2 years has not made anything, especially when they factor in the expenses. These are the facts. REAL former Algo using idiot speaking here. If you have an extra 20-25k this is NOT the place to invest!!!!!!!!!!

Tough crowd.

Poor customer F is down 10-15k when you factor in what he/she paid for the shitty algos, and he will be down over 20k again after the next drawdown. There’s better retail algos available for 50/month if that’s what you want to invest in.

Algorithmictrading.com sounds great, but the fact that I’m still on the fence bothers me. If this trading platform works as advertised, then would it be that far fetched to consider it priceless?

In theory, a successful algorithmic trading platform would be priceless to the owner of that platform, as well as to any potential buyers of that same platform. In a previous thread listed above, the owner, Richard, mentioned that they have about 100 people trading this algorithm. Really? Only 100 customers for a product/service that can be interpreted as priceless? Something doesn’t smell right. Screaming Bernie Madoff Ponzi scheme to me.

From my point of view, Algorithmictrading.com is either a priceless trading platform or a Ponzi scheme. How can it be anything else? If it’s not a Ponzi scheme and its not a priceless trading platform. Then what is it?

Hope I’m wrong about it being a Ponzi scheme, but doubtful its the priceless trading algorithm/platform we’ve all been waiting for. Any customers out there that made it big and then successfully cashed out? It should be REALLY easy to find happy customers that are singing this companies praises. And singing them loudly and unsolicited from your nearest rooftop.

Is there no one out there that can write an honest review? And by honest review, I mean you have had to at least vetted the platform. Ahem, looking right at you Emmett. Anyone ever write a review on a movie that you haven’t seen? Ever write a review on a restaurant/meal that you haven’t been to or tasted? How about a car that you haven’t test driven? I don’t think so. What makes Emmett think he is qualified to write a review about a product that he hasn’t even vetted personally himself? Quite misleading at best. And Emmett, if this is your blog website, shame on you for not fully vetting any and all products/services you review.

There has to be transparent customers out there. If for no other reason than just providing a public service as to the legitimacy of this companies products/services. Why aren’t there any public statements that have been audited/confirmed? In theory, every customer should have the exact same results every day/week/month/year etc. So it shouldn’t be that difficult to find multiple customers willing to share this info. I understand that some factors can affect individual results. Such as the starting acct balance and timing as to when someone gets in and starts using the algo. Human/user intervention in executing their own trades or not letting the algo run 100% of the time will also affect individual results. But if all things are equal, every customer should experience the same percentage results as one another on any given day/week/month/year. Right? Where is all this info? Why isn’t it public and easier to find?

Not too interested in simulations when you’re asking for a non-refundable 20% fee upfront. This is real life. Where are the real life success stories?

Im still on the fence, but still quite vulnerable to a violent push to the side of algorithmictrading.com, just not there yet. I am available for further discussion and debate if more or better info is available. Waiting to be sold…

You should wait a long time indeed… The client statements listed on their website took 8 months to get up to a total of about -15% loss in net total. This client is not yet profitable but could be over enough time (If nothing changes). You are uncomfortable because the service is WAY the hell overpriced for the amount of risk it takes on… Just walk on and forget it. You will be glad you did… Any temptation you are feeling is emotional only and not based on fact. Nice guys or not, they are selling massive amounts of bullshit in a gamblers casino… Do your homework and think for yourself!!

I am sorry but I do not care how many stars Emmett gives this algo. Do you really think someone is selling their profitable Trading Algo? Where do you think he makes his money from live trading of this algo or from selling his algo? You ask where are the profitable trades. I say think Occam’s razor for your answer. Everyone I know that has bought an algo, it made money until the day they bought it. Then it just went down down and down.

I am sorry, I am negative. You go ahead and buy and post the results you get.

Unfortunately in face of the review rating, it sounds like a poor investment to me. The “cons” are rightly reviewed as too high. The business seems to be well credentialed as well as the manager. But that’s about it. The results after over a year seem barely marginal. Comparable to a site such as “legacy” Netpicks” with their seven summits algo. Maybe rich folks are better off investing in a real hedge fund that uses algos. I hear you RobB. An algo or Forex EA seems to “work” according to the advertising until a retailer starts to use it. I’m sure many have heard of DonnaForex.com where they review MT4 EA’s for years, but never found one consistent trading EA.

How much does this system cost if you want to trade say a 35k account? Thanks.

It’s quite a lot. It costs about 1/2 – 1/3 of your account. 15k account costs 5k and 30k account costs 15k. So, yeah quite a large portion of your account value…Anyone else have any experience with this company?

All the negative experiences above and elsewhere not enough for you?

The reviews on BBB looks good to me.

Any more experiences? Good or bad? Seems like a great company, just a bit costly.

Nice research Emmett. I am convinced that this company algorithmic software is the real deal.

I’ve heard most of the long-term customers are happy with this system. The service had a 60% run this year for a couple of months. I think a lot depends on when you get in. Some people on here got in during a drawdown month and didn’t stick it out.

The problem is this: if you get in on a major drawdown (having already paid through the butt for the service), you’ve got a huge problem on your hands. Homelessness is tough. Current market conditions are highly volatile, certainly not the kinds of conditions where you want to turn your money over to a machine that has only the amount of “intuition” that the programmer has managed to instill, while you yourself have as much intuition as you are capable of, and willing to develop. It might be a long time before prevailing market conditions can be handled properly with anything less nimble than the human brain.

People still signing up for this crap? The huge drawdowns, tons of negative reviews, mediocre returns, and ridiculous cost aren’t enough to convince you to avoid? The only person who has made $ off this thing is the owner of the website. And most likely he’s made 7 figures. He has made ZERO from trading!

Precisely correct.

emmette! Your reviews are good!

please review prop trading system like mes capital / blue point trading. Please tell us how legitimate this firms are. Please give the second part review of TOPSTEPTRADER.

thanks

John,

How long have been a customer? When did you start?

I purchased these at full price and experienced huge drawdown. If you want to buy them for 1/2 what I paid please let me know. I don’t trust them.

Hi John, can you please advise how long have you been using their system after experiencing a huge draw down?

Every system has drawdowns. As Emmett says, it’s part and parcel to any trading system. It seems to come back from them extremely well. Just rockets out of them.

The algo lost at least 10% for Dec 2015.

I had been away from the market and in returning I wanted to investigate algos and autotrades as a way to keep me from overtrading. This group seemed sincere and the returns, yet not great, were at least positive. But I kept hearing “drawdown!”

Then the rep told me the entrance fee, $15,000, and I could not control my outburst and then there was the $15,000 to trade ONE unit overnight five different ways. $30,000 for very slight returns and now another minus 10%?

Be careful out there my friends1

Any others (who have not posted already) who could describe their experience so far with the program?

looks like they are not posing November results on line as it was a wash.

Results not very impressive for having to tie up as much money. Suggest you visit C2 (Collective) and study that for a while. There are some gems in there and much better,

Now I know tradingschools.org is a sham. Google ad for algorithmictrading.net says 8.68% per month since 2003. Here we even have the owner of the site admitting otherwise. Anyone who knows scams knows the BBB and ripoffreport mean absolutely nothing because they are both easily paid off.

Would you like for me to do a follow up review, complete with audited account statements? It has been awhile.

Thanks for expressing your opinion. Writing these reviews is seriously hard. But thanks for stopping by and reading. Hope to read more of your comments in the future.

Not needed. It works but way too expensive.

Emmett: Yes! A followup would be great. Have been following this system for over a year. There has been a large amount of discussion on both sides, i.e., for and against this system. There are not many “auto-trade” systems that appear to exist, and I’m not sure if any are worthwhile. Jumping in to Algorithmic is a big cost factor. If it is legit, then I, like, I would assume, most, don’t mind putting up money for a valuable return. So again…YES. please do a followup.. and as always…thank you for what you do here.

Alright. Let me contact the vendor and start pulling account statements and interviews with current customers.

Emmette, have you verified acct statements with real live customers?

Emmett, yes, please write an update to this review with complete audited statements.

It would be great if you could do a follow up review. I also looked at their back tested results and I could not match their performance to the statements that they publish in their website, so it is confusing the data they are providing.

The reason for that is they release a new updated version with new backtest history after every drawdown. So the huge drawdown that everyone experienced will not be shown on their backtests. This is a common trick among sellers of automated systems.

I saw that also. But even comparing the statements for the newest algorithm (Active NQ trader V2) vs the monthly back-tested results (which I am assuming were for the latest algorithm v2), these did not match. So I would be interested in understanding what exactly I am looking at.

Kinda concerning that you are excited about their BBB rating. You realize BBB is a private company that you can ‘pay’ off to be re-reviewed a little more favorably.

I am a customer of Algorithmic trading. You can’t make everyone happy all the time but they have made me happy. Things have changed since this was written. The Trade Station Platform is no good and they have changed to Gain Capital Corp who executes the trades. Fox Group in Chicago oversees Gain to keep them in check and watches for slippage. I remember when I started and it was Tuesday night when it went live. I got an e-mail – automatically generated that there had been two trades intiated. The algos ran all night automatically and got out about the time the markets opened. I was up. Couldn’t believe it. Second day was profitable also. On Friday I lost $300.00 as the algos closed out the trades early. THREE days of trades and I was up 9.54%^. Not a lie, not a scam, no BS. Algorithmic trading sells you a lifetime trading authorization to trade their algos. The old saying of “You get what you pay for” applies here. If you want something good you will have to pay for it. If you want cheap you will have to go somewhere else. Yes, I am a real live bona-fide customer of Algorithmic trading . Org.

They are a seller of a trading package. The trader is Gain Capital Corp in New Jersey who is a licensed broker/dealer. The Fox Group, who is also a licensed broker dealer oversees Gain Capital. If you read the first page of Algo Trading web site it does NOT promise you that you will have an 8+ % profit every month. Don’t twist the words. Sure there are losing months. EVERY system loses money occasionally or “draw downs”. I was probably as skeptical or more than anyone else before I put my money in. I know where my money is because I get an electronic statement EVERY day. I know my balance EVERY day. FUTURES are not for everyone. If you are a bad stock trader, you are a bad trader. Everyone is not created equal. Algorithmic trading is a machine traded system which works in it’s parameters. It does what it is supposed to do. It is customer “hands off”. The client just watches. I am a customer and I watch it happen. How much I have made is no one’s business but it has done much, much better than I could do on my own. I have said my what was on my mind. It is everything it is supposed to be and more. It is a great system that works. NO ONE makes or expects to make 100% a year trading for their own account. It doesn’t happen. This system can make it happen

Thanks for the reply, Ricky. I appreciate the candid information. While I respect that you don’t want to come out with too much information about your account I would be curious to know more: you can reach me at intoinfinity7NOSPAM@gmailNOSPAM.com thank you.

Hello, i would like to know more also. novadolla@gmail.com

Sounds like your about to fall for their marketing sales gimick too. There are a ton of negative reviews on the internet on them including this comment thread, so not sure how you’ve heard only good things.

Send me your Skype and I’ll send you the system that’s 90% cheaper with better performance. Or look around on your own their are lots with refund options and monthly payment options

If this product was priced accordingly, which I think should be maybe $25/month and had a refund option then their would be a problem. But they are spending a fortune on advertising to naiive people who are losing their savings with them. Don’t be one of those people.

Mike

“Send me your Skype and I’ll send you the system that’s 90% cheaper with better performance. Or look around on your own their are lots with refund options and monthly payment options

If this product was priced accordingly, which I think should be maybe $25/month and had a refund option then their would be a problem. But they are spending a fortune on advertising to naiive people who are losing their savings with them. Don’t be one of those people.”

What are those other options?

What are you trading?

What sort of capital are we talking about?

It’s all very good to make these statements, but I would like to know that background to those statements you are making.

Regards